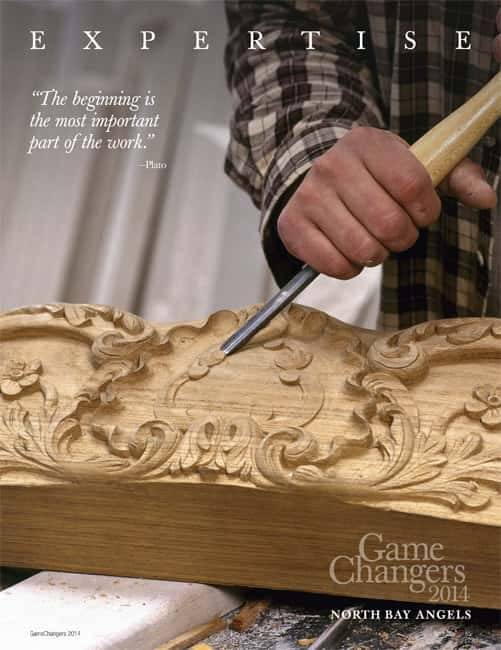

“The beginning is the most important part of the work.” —Plato

The North Bay, while not Silicon Valley, has had a steady stream of startups over the last couple of decades, many of which have transformed the economic landscape north of the Golden Gate.

TriVascular Systems, for example, is now one of the top manufacturers nationallyof medical implants. Red Condor is a leader in email security systems. And don’t forget Alantro Communications, a producer of integrated circuits for communications applications, which was bought out by Texas Instruments in 2000.

How did they do it? Literally on the wings of angels—North Bay Angels, to be exact.

Since 1998, this group of accredited investors, now numbering more than 40, has invested millions and millions of dollars, many times over, to bring new ideas to life. In short, they answer the prayers of entrepreneurs.

Che Voigt is the current chairman of North Bay Angels’ (NBA) board of directors and has been involved with the organization nearly since its inception. Voigt lives in Santa Rosa and is president of his own startup, SV Tool, which builds furniture for high-intensity computer users. When NBA started, Voigt, who grew up in an entrepreneurial family, wasn’t an accredited investor, so he volunteered his time to help the growing program. (To be an accredited investor, under U.S. law, an individual must have a net worth of at least $1 million, not including his or her primary residence, or have earned $200,000 in income for the previous two years—$300,000 if married.)

“I read hundreds of business plans as an intern for the group,” Voigt recalls. “From that experience, the next company my family founded was much more successful because of what I’d learned. Even though we never got an investment from [NBA], we did get board members and consultants who helped us out.”

Voigt’s company was Sonoma Design Group, which sold to L-3 Communications, an aerospace and defense giant, in 2005, and was renamed L-3 Communications Sonoma EO, Inc. The company is still located on Aviation Way in Santa Rosa. After the sale, Voigt had achieved Fortune 150 Executive status and became an accredited investor. The Angels asked him to join the board. He eventually became its vice chair and is now its chairman.

Voigt’s company was Sonoma Design Group, which sold to L-3 Communications, an aerospace and defense giant, in 2005, and was renamed L-3 Communications Sonoma EO, Inc. The company is still located on Aviation Way in Santa Rosa. After the sale, Voigt had achieved Fortune 150 Executive status and became an accredited investor. The Angels asked him to join the board. He eventually became its vice chair and is now its chairman.Conduit to “can do it”

The hardest thing for a potential entrepreneur with a new product or idea is to secure seed funding, even in the best of times. And over the last several years, as the North Bay weathered the recession, it was nearly impossible to get traditional financing. As such, North Bay Angels took on an even more important role in getting the North Bay economy back on track.

“We see our role as a group of like-minded, active investors who are in some way related to the North Bay, and our goal is to put together a room of investors with entrepreneurs who have good investment opportunities—and we hope it results in good investment decisions,” Voigt explains.

It’s important to note that the individual angels make all investment decisions—NBA doesn’t invest as a group. It’s also important to explain that while NBA members do make cash investments with the hope of eventually getting a financial benefit, many also become involved with the startups as mentors, offering their own expertise as well, as was the case with Voigt’s Sonoma Design Group.

The process

There’s an old saying that “fools rush in where angels fear to tread,” and when it comes to loaning money to startups, investors will tell you that it’s definitely wise to tread lightly and do your homework. The process set up by NBA is one that benefits both the investor and the startup.

“The first thing that happens is we’re in some way connected—through networking, via the Web, a referral from another angel group or perhaps through members of our own group—to companies that are interested in presenting their business opportunity to us. They submit their information to us on our website and we then invite the most interesting ones to a screening meeting,” Voigt says. “Usually, we’ll have two to five companies at the screening and they’re competing for one to three presentation spots at an upcoming members business or dinner meeting.”

The screenings cull out the deadwood and the “not quite ready for prime time” players. “We never bring an opportunity that’s really poor just to fill space on the agenda,” Voigt says. “We don’t believe in bringing garbage to our meetings.”

In some cases, the ideas aren’t bad, they just need a little more time to ferment. “Some of the companies we screen have potential, but they just aren’t ready. Since we only give a company one chance to make a presentation to the group, it’s better to have them come back when they’re ready,” Voigt explains.

Once a company makes the cut, it meets with the NBA membership and makes its pitch, hoping for investments. Once the meeting concludes, the NBA’s relationship with the company officially ends, and it’s up to the individual NBA members to follow up with the companies regarding their interest.

Voigt frequently invests in presenters’ projects, along with other angels. “Each of us co-investors has different ideas and skill sets. It’s best when you can find complimentary groups [of investors], because it makes the entire investing process much easier. Making an angel investment is a huge amount of work. It takes a lot of due diligence. Many investors do it on their own and they’re fine with that, but it’s so much easier as a group. It spreads the workload out, makes it easier and also means other people can work with these companies later down the road. All are projects that need a lot of help and we do whatever we can to help them along—not just money, but expertise as well.”

Invariably, NBA is one of the early deals each of the startups makes, Voigt says. And they need so much more to help them move along. “They need education on funding processes, execution, company structure, board participation,” he explains. And the angels soon become the wind beneath their wings.

“The most successful deals are when one or more of our members has a lot of interaction with the company.”

The personal touch

NBA investors make personal decisions based on their own interests, as does Voigt. Raised in Sonoma County since the sixth grade, Voigt has watched the evolution from rural agrarian to world-class wine and high tech. “Legend has it my family brought the first fax machine to Healdsburg in about 1980 or 1981,” he laughs.

His personal mission is to get similar businesses to come to the North Bay to form clusters, which he believes is important to the economic stability of the area. “Having similar businesses makes it easier to hire and have people be willing to move into these counties. There’s a symbiotic effect of having companies that use people with similar skill sets—not necessarily competitors—so people feel more secure about moving themselves and their families. Most are dual-income, so a trailing spouse also needs to have good employment opportunities. You see more and more couples where both are technical professionals and both are looking for opportunities.”

He’s also a bit of a North Bay cheerleader. He believes the North Bay offers a better business climate “because the typical cost of doing business is less—as an example, Sonoma County is 7 percent less than the national average, according to Moody’s,” he says. He also believes advantages are better for companies involved in light manufacturing because “there’s more space, you can do it for less in the North Bay, and yet you still have very rapid access to one of the most exciting economies in the world right now, which is the San Francisco Bay Area,” he explains.

“This is a personal passion project for me—and for the others,” Voigt says. “Sure, we like to make a return on our investment, but we also see it as a community service to build this ecosystem.”

Riding the cycles

Opportunities for investing in North Bay companies abound and what’s “on the market” at any given time depends a lot on the current investing cycle. Since it started 16 years ago, North Bay Angels has seen “two significant boom and bust cycles,” Voigt says, “and the type of deals we see in the North Bay are the function of location, the economic cycle and people. Sometimes we see companies that have customer traction, but need money to hire a sales force. Sometimes they just have a prototype and haven’t gotten anywhere else. And sometimes the business has traction, has been operating for a number of years and the founder is just ready to take it to the next level and grow.”

In addition to funding startups, North Bay Angels has what it calls “Flex-Mezz” opportunities for North Bay companies with proven management. These companies may not appeal to angel investors because they don’t have extraordinary growth potential even though they can generate dependable cash flow. Flex-Mezz (mezzanine) funding is generally used for expansion or acquisition, and investors expect lower returns than they do for angel investments.

Voigt notes that NBA investors tend to “not as be fad-oriented as Silicon Valley, because we’re outside Silicon Valley and we tend to like deals that have a connection to the North Bay. For example, North Bay Angels has a reputation for knowing more about the wine industry. One of our portfolio companies is Vino Volo, the wine tasting bars that started out in airports. It’s a real success story and the company is doing great. So that’s an example of a company that wants to have a connection with North Bay Angels because of the contacts we have in the wine industry, even though it’s headquartered in San Francisco. Another is NonProfitEasy, a back office software company for small- to medium-sized nonprofits. That type of deal is a great Silicon Valley deal, but the company is based here, so that’s the connection.”

The very first company North Bay Angels members invested in was TriVascular Systems, which today has 250 highly paid employees and a major presence in the North Bay. Since then, 67 other companies have been beneficiaries of NBA members’ largesse. Last year, 43 percent of the companies that made presentations to NBA received some sort of funding from investors and, since it first started, 36 percent of those making pitches have been funded.

“Those are high numbers,” Voigt says. “Depending on the nature of the group, most angel organizations usually fund only about 10 percent of the deals they’re offered.” In the last two years alone, NBA members have invested nearly $16 million in angel deals, follow-on angel rounds, venture funds, investments into their own small-startup companies and Flex-Mezz, making it safe to say that, without North Bay Angels, the North Bay economy would be a lot more like hell than heaven.

NonProfitEasy

NonProfitEasy

Lomesh Shah is president and co-founder of NonProfitEasy, a software platform that streamlines the operations of nonprofits, managing such things as volunteers, donors, events, workshops, membership and fund-raising. It’s a spin-off from IQR Consulting, based in Santa Rosa.

Shah, who lives in Santa Rosa, learned about North Bay Angels while mentoring at the Sonoma Mountain Business Cluster (now known as SoCo Nexus) in Rohnert Park, where he met a few of the NBA members. When it came time to separate NonProfitEasy from IQR Consulting, he approached NBA and was granted presentation time.

“The great part of it was that, once we were able to get in front of them, the process moved very quickly. We were able to line up about a dozen investors in short order. Our first round of fund-raising was done in a matter of three weeks, which is super fast. That was great for us, because we didn’t have to lose focus on what we needed to be doing. Fund-raising usually takes a long time and lots of energy,” he says.

In two rounds of funding, NonProfitEasy has raised close to $700,000 in angel investments. “It’s substantial support, not only regarding money, but also in the expertise that the members [of North Bay Angels] bring into the equation. When they come on board, they’re more than happy to lend guidance as well as money.”

Altus Equity Group

Altus Equity Group

Altus Equity Group, headquartered in Santa Rosa, is a boutique alternative asset firm focused on real estate. It’s been around since 2009, when Expowth Inc. merged with Inland Management Group, Inc.

“We provide better than market risk-adjusted return for our investors by investing in things other than stocks and bonds. Our main focus is real estate and debt, but it could be businesses, receivables and all sorts of things,” explains Forrest Jinks, founding partner.

“We put together investment funds around specific strategies, mostly in real estate, and raise investment dollars. It’s usually a yield-producing investment, so they get return from the time they put their money in and we’ve gone to [North Bay Angels] two times. As far as I know, we’re the only real estate company they’ve funded to-date,” Jinks says. In September 2012, Altus raised $700,000 from NBA members and just last January it raised another $750,000.

One of the members of NBA, Michael Adler, became an adviser to Altus Equity Group “and remains one today.” Mark Nelson, another member, is now a major partner in Altus’ operating company.

“They were great to work with. We presented to their screening committee and they offered us feedback. Someone from the screening committee then worked with us on prepping our presentation before the full membership. In our case, it was Michael Adler both times.”

Jinks’ experience with the group was so positive, he ended up becoming a North Bay Angel himself, and so did another Altus employee. “Several of our non-NBA investors then saw what they were doing and they’ve become members of North Bay Angels as well,” he laughs.

The best advice Jinks can give to someone planning to approach North Bay Angels is to “listen to the advice they give you. They’re going to help you prepare to present. Don’t say you can do it on your own. If they see you don’t want to be coached, it’s a bad sign. If you’re an investor, you don’t want to invest in people who think they know it all.”

Jinks says North Bay Angels, and angel groups in general, “provide an important service in our economy. They get small companies up and going that don’t have access to money otherwise. Small companies are where most of the jobs are in our economy, and I really think the angel organizations are important. And North Bay Angels are really great. There’s no pretentiousness. They really want to help people. Yes, they’re investing and they want to make a return, but they’re very generous with their time as well.”

Visicon

Visicon

George Linscott is president/CEO and chairman of the board at Visicon, a technology leader in machine vision for the sub-micron inspection market and the market leader in medical stent inspection systems. The company’s office is in Napa.

“We provide machine vision to inspect small things. We’re talking in the micron range,” Linscott says. “One of our main markets is coronary and medical implants that are so tiny you can’t measure and inspect them reliably with just human vision or existing tools—and those things are really important because they’re going in your body.”

Visicon was founded in 2001 and its first angel investors included members of North Bay Angels in 2007 ($1.1 million). Later, it received $450,000 in Flex-Mezz debt funding—the first company to receive such investments from North Bay Angels members.

Linscott, an angel investor himself (previously with Sacramento Angels), knew of NBA through his own connections.

“Visicon has been supported by several angel groups, but North Bay Angels has been the most helpful by far,” Linscott proclaims. Not only with money, “but with guidance and expertise.” And referrals. “They’ve referred us to customers who can really use our technologies.”

Linscott notes that some angel groups operate like the television reality show on ABC called “Shark Tank.”

“Presentations are only half-jokingly called ‘Christians versus lions’ in those sessions,” he laughs. “But it’s not like that with North Bay Angels. I’ve had different experiences with different angel groups. Some have a lot of investors from big corporations who don’t understand the entrepreneurial mindset. North Bay Angels has a good mix of members—entrepreneurs, bankers and people from bigger companies. And they’re angels in a more positive way. But that doesn’t mean they just hand out money to everybody.”