Recall that gag from Austin Powers when Dr. Evil, transplanted to 1997 from the Swingin’ Sixties, vows to hold the world at ransom for $1 million—only to have his nonplussed No. 2 observe that amount “isn’t exactly a lot of money these days…”

Well, the other shoe has dropped, One Hundred Thousandaires.

It only seems like yesterday when crossing the threshold to a six-figure salary was the benchmark for a so-called well-paying job.

But, according to the latest calculations from the U.S. Bureau of Labor Statistics, the threshold today for high-earners is more like $133,000. At least, that’s the salary one would need now to have the same purchasing power as $100,000 a decade ago. (Take the Wayback machine to 2003 and you’d need to be raking in $168,000 today.) And who’s the culprit sending yesterday’s Daddies Warbucks to the bread line? Inflation. (And that’s no exaggeration. According to a recent report from LendingClub, more than half of Americans earning more than $100k a year live paycheck to paycheck.)

Inflation rose at a rates of 7% and 6.5% in 2021 and 2022, respectively, according to the Department of Labor—triple its highest rates since 2013, putting a major crimp in purchasing power for salaries across the board. (Inflation is sitting at about 3.2% in 2023.)

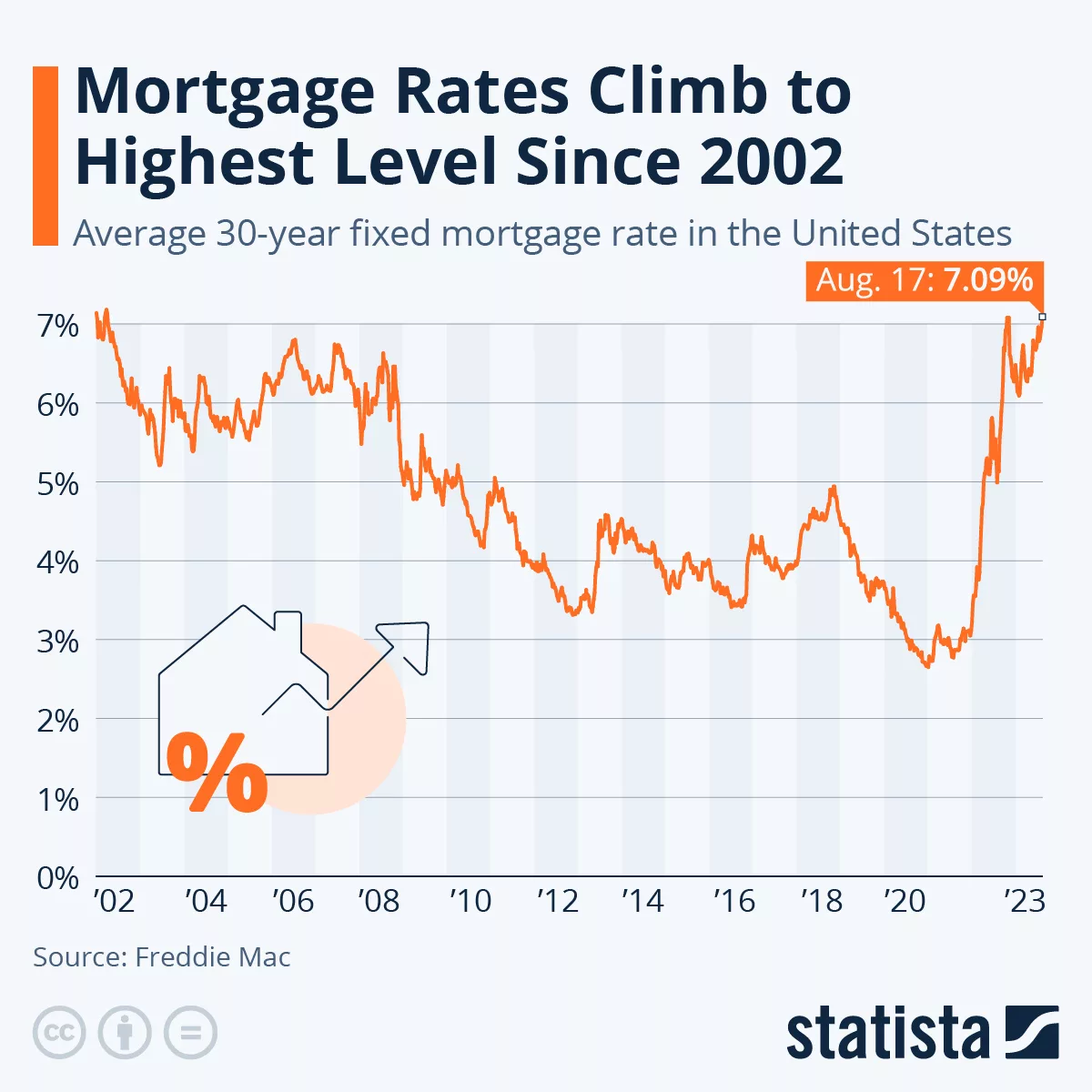

Of course, various salaries go a lot further depending on where one resides. In San Rafael, the average monthly rent for a 2-bedroom apartment is $3,433, according to rent.com. In Santa Rosa, it’s $2,608; Napa, $3,170. Nearby, other “big” cities in the Bay Area check in for 2-bedroom rentals in a range from $2,050 (Vallejo) and $2,516 (Hayward) to $4,913 (San Francisco) and $6,289 (Berkeley). And yet jumping out of the rental market into home ownership grows harder, with 30-year mortgage rates continuing to climb higher this summer—cresting 7% in August, their highest level in more than 20 years. (See graphic)

Meanwhile, the Fed recently initiated a 0.25% hike to its federal funds rate—the 11th increase in the current rate-hike cycle—in an effort to rein in inflation.

That Dr. Evil scene gets funnier every day.

5 thoughts on “The new Drs. Evil: Inflation, rising mortgage rates…”

JeLaViIQbAf

I loved as much as you will receive carried out right here. The sketch is attractive, your authored material stylish. Nonetheless, you command get an impatience that you’ll be delivering the following. I’ll unquestionably come more formerly again since it’s exactly the same nearly a lot often inside case you shield this hike.

I do believe all the ideas you’ve presented for your post. They are really convincing and will certainly work. Nonetheless, the posts are too short for novices. May just you please lengthen them a little from subsequent time? Thanks for the post.

YRLdefrhDtZC

xeKhNHzC