Unless you’ve been living under rock in recent years—which in the Sonoma County real estate market would likely have a hefty price tag—you’re likely aware of the cost of living and the strain it has on just about everyone. Younger generations especially have added pressure to succeed as they find their independence after high school and college—but how is it possible unless the financial fundamentals are instilled early on?

Financial literacy in the U.S. has hovered around 50% for eight consecutive years—meaning around half of U.S. adults are financial illiterate—with a 2% drop in the past two years, according to the World Economic Forum’s data index from 2024.

Notice is being taken. From local nonprofits to government sectors—the importance of making financial literacy a core staple in classrooms and beyond is finally taking precedence.

Recently, Assembly Bill (AB) 2927 was passed through the California state legislature (Gov. Gavin Newsom pledged to sign it into law later this year), which would make California the 26th state in the union to require personal finance as a high school graduation requirement.

The bill will add completion requirements of a personal finance course for graduates of the 2030-31 school year, according to a press release from the California Department of Education.

While this is a positive move toward a larger goal, Sonoma County nonprofits and local educators have already been making strides to instill financial literacy concepts in kids and teenagers for years. Here’s a closer look at what the community is doing to make an impact.

Money smart at the library

The Sonoma County library has been the recipient of a California state grant known as the Summer Lunch at the Library program since 2016. While the funding ensures that children get access to nutritional lunches during summer break, the library developed additional programs throughout the season to enrich children through the funding—one of those, Money Smart, is a national program that teaches financial literacy.

Rachel Icaza, education initiatives librarian for Sonoma County, launched the Money Smart: School Supplies Store in seven of the 14 local libraries. The selected libraries are those in areas with an underserved demographic. The program is designed for kids from as young as kindergarten all the way to 17, and gets them ready for their return to school while they familiarize themselves with the concept of money management.

“This is a financial literacy event that results in kids going home with school supplies,” says Icaza. “Going back to school, supplies are essential,” she emphasizes.

To make the experience mutually beneficial, they made a “shop” in the library, using “Otto bucks,” or fake money stamped with an image of library mascot Otto the otter.

Additionally, the library hired interns to set up the store and work as cashiers.

“Paid teen interns use a [toy] cash register, set up all the supplies, and the participating kids all receive 40 Otto bucks to spend,” she says.

The kids are then presented with different school supplies with prices attached.

“They discuss with their parent or child-care provider that they attend with about what they need,” she says.

“A ruler? Notebook? They make a little budget, get a shopping list together, take it all to the cashier and count out how much each thing costs.”

The participants learn about money, adding, subtracting and even socialization skills by shopping for school supplies.

Once their items are purchased, the kids can additionally “rent” the use of the button-making machine to enhance their back-to-school supplies with customizations in a fun and creative way.

“They rent the use of the button maker,” she says. “We have all kinds of artwork in the right sizes for their backpacks—Barbie, Batman, etc.—and kids make their own designs and put [them] in a machine and a hand crank makes a zipper pull for backpacks or jackets.

Buying, renting and borrowing are all concepts examined during the experience.

“We used to go to Blockbuster when we were kids and rent movies, but kids today don’t rent things,” she explains. “They borrow at the library, so we teach them how to buy, rent and borrow. Kindergartners don’t usually get that concept and are leaning.”

The grant money provided the libraries with 800 sets of school supplies—each includes one backpack equipped with 20 pieces of additional scholastic items. Each of the seven locations had 115 backpacks to use for the school supplies store, resulting in a whopping disbursement of a total of 650 essentials-filled backups for local kids.

“We’ve been recipients of this grant since 2016,” she says. “This year and last year were especially generous opportunities. Next year will be different with budget changes—it won’t be to the same level again.”

Icaza aims to continue the event annually, grant or no grant.

“I’m going to make sure we manage to do it even if the grant can’t.”

What’s more, the library hired 14 interns, between the ages of 16 and 18, to work as cashiers for the makeshift store.

“We were able to budget California minimum wage as well as testing them for bilingual pay,” says Icaza. “They can take those test results to other jobs, and they understand the value of that—their skills equal more money.”

Credit union offers a bite

As for the more mature teens who are preparing to flee the nest and financial independence is on the horizon, a local credit union is rich in resources.

Redwood Credit Union (RCU) has been spreading the wealth—of information, that is—on financial education for decades.

“RCU has been committed to financial education for more than 20 years,” says Matt Martin, senior vice president of community and government relations.

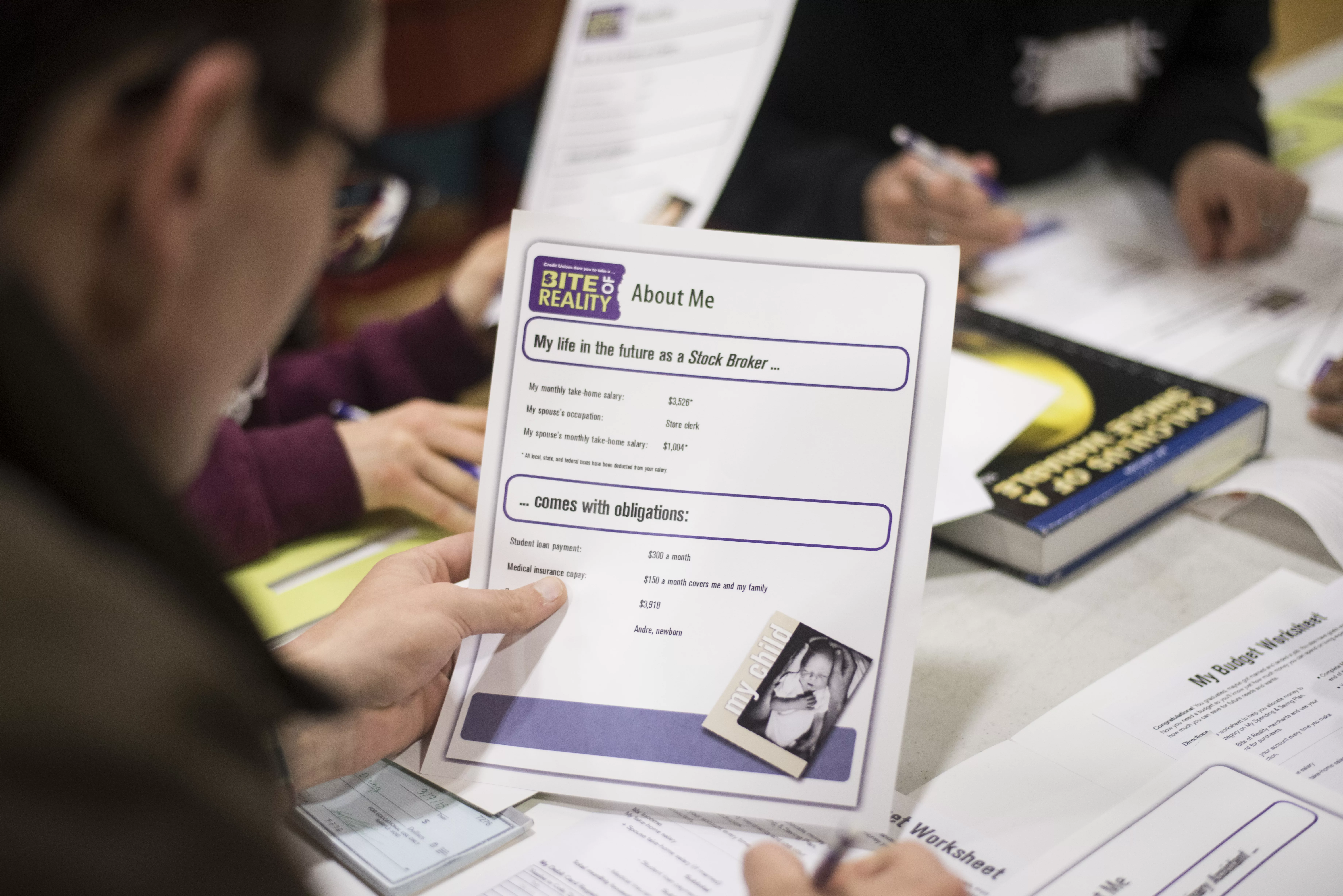

In 2013, RCU began offering the Bite of Reality simulation, a workshop created for high school students designed to immerse them in personal finance.

Using a mobile app, students are given an occupation, credit score, dependents, credit card debt and other various obligations.

“We set up tables with volunteers and partners to be vendors at various stations,” explains Matt Kanzler, financial wellness specialist at RCU.

The workshop features nine stations in total, eight of which are staffed by volunteer “vendors,” who sell such products as housing, transportation, child care, food, clothes, entertainment, even makeup and skin care. The students purchase items from every station based on the salary profiles they were given at the beginning of the simulation.

“We encourage vendors to upsell and try to push high-priced items as if they’re venders making a commission,” says Kanzler. “We encourage the volunteers to use all sales tactics and peer pressure that we see in real life to give students a bite of reality.

The ninth station is a credit-union station. When students go over budget, volunteers at the credit union station guide students to return items they didn’t need and focus on what is essential.

Some of the profiles in the app are low-earning incomes, requiring a much tighter budget. They also make sure that each profile’s occupation can provide for one lavish item, although the credit scores do make an impact.

Redwood Credit Union says it has reached more than 41,000 people through more than 900 financial literacy presentations and sessions. They’ve run more than 240 Bite of Reality simulations reaching nearly 21,000 individuals.

“Financial literacy is crucial for young people to build a strong financial foundation,” Martin explains. “It empowers them to make informed decisions, achieve financial goals and contribute positively to their communities.”

RCU additionally offers community support through grants and sponsorships, as well as online resources for self-guided learning.

“Our goal is to equip young people with the knowledge and tools they need to thrive financially.”

Kanzler best describes the program as experiential leaning, emphasizing that with the new legislation going into effect by 2027 requiring schools to teach financial literacy.

“It’s a great accompaniment,” he says.

“There are several schools getting ahead of it already that have created a financial curriculum, freshmen to senior year,” says Kanzler.

One of those schools happens to be right here in our backyard in Sonoma County.

Maria Carillo at the forefront

The pumas at Maria Carillo High School (MCHS) in Rincon Valley are no stranger to Bite of Reality workshops on campus, having held the event for the past five years.

Additionally, the high school is the first locally to implement financial literacy in its curriculum.

“We’re the only campus to have an integrated CTE [career technical education] with English or any other subject area relationship where students are using math and business readiness skills to do projects and host events,” says Trisha Terrel, English teacher and work-based learning teacher at Maria Carillo High.

“Financial-applications math is a new course that a couple of schools in Santa Rosa City Schools started piloting about three years ago,” she says.

“We also have a CTE pathway program for students in our auto, culinary and sports med pathways.”

While all seniors in California are required to take government and economics to graduate, the additional courses such as financial-applications math and business-prep English are by choice, she says about courses which apply math formulas to finance situations and communication techniques in the business world, respectively.

“This year, I brought a proposal to our team of department chairs and asked for support in hosting an all-senior class Bite of Reality through Redwood Credit Union,” she says.

“I’ve hosted these for smaller groups of our CTE students in the past, but I definitely see the need for all kids to have financial literacy—especially as a mom of a student who graduated from Maria Carillo in 2023.”

The response from students is always positive, opening their eyes to the reality of life beyond high school.

“The Bite of Reality is the quickest and easiest way to educate students about the reality of what it costs to make it after high school,” she says.

“Kids say it’s fun, but very eye-opening—and almost every one of them says they have a new appreciation for how their parents support them financially.”

She’s found timing is key for some topics—like saving, loans and credit scores. She likes to offer those classes or workshops during the spring semester when seniors are excited about nearly being done with school, but also in “the wondering-how-I-am-going-to-make-it phase.”

10,000 Degrees

San Rafael nonprofit 10,000 Degrees has been providing financial literacy workshops to students since 2018. Educational equity is its mission, giving support to students furthest from opportunity so they can achieve success throughout college and beyond.

Their Money Matters program goes into high schools throughout the Bay Area, offering two different versions in which students can participate. Option one, is its Budgeting for College workshop. Students receive a college portfolio with a sample offer letter. They apply a financial aid amount to pay for essentials like books, supplies, personal hygiene—anything they would need while away at college.

“It teaches them to use their financial aid and budget it properly,” says Maria Hernandez, senior manager of program operations at 10,000 Degrees.

“The valuable lesson is that college is affordable when financial aid is properly used.”

High school sophomores, juniors and seniors are eligible to participate.

The alternative program is the Money Matters workshop, which focuses on careers and day-to-day expenses.

“Students get a portfolio with a packet of job titles, income and a job description,” says Hernandez.

The portfolio shows a yearly salary broken down to a monthly income—and participants use the income to budget day-to-day costs such as housing, transportation, groceries, savings and entertainment.

“The goal is to show students that the career they have and their post-secondary education impacts what they can purchase, as well as earning potential,” says Hernandez.

Last year, the nonprofit completed 30 workshops at more than 18 schools within the seven counties it serves, including Marin, Sonoma, Napa, Lake, Contra Costa, San Francisco and Santa Clara.

With more than 2,000 student participants in 2023, 10,000 Degrees’ goal is to increase its Money Matters reach annually.

“Next year’s goal is to have more events and more students participating. We’re aiming to do 30 to 40 by the end of this year,” she says.

For schools interested in hosting a Money Matters workshop, 10,000 Degrees’ website has an event-request section. Volunteers can sign up as well.

“There are 11 tables [throughout the event] that need volunteers to operate them and engage with students,” says Hernandez.

“We include 460 volunteers across 34 organizations. There’s a lot of local participation. This year we hope to continue that. No volunteer experience needed.”

For information on how to plan a workshop or be a volunteer at a future event, visit 10000degrees.org.

Bottom line

The increasing awareness of the importance of financial literacy is fueling businesses and nonprofits to develop more engaging ways of reaching young people. From workshops to community centers to schools, the opportunity to learn personal finance is making an impact on all ages.

Get financial savvy at home

Apps that will guide your family to being financially literate

From kids to adults, financial literacy may be a skill that needs some fine tuning. Luckily, there are apps for all ages that are engaging, and can strengthen a user’s ability to understand and apply financial knowledge

Here are the 6 apps to know about:

- World of Money: Best financial literacy app overall

- Zogo: Best financial literacy app for bite-sized lessons

- RoosterMoney: Best allowance app

- Investmate: Best for investing education

- FamZoo: Great for families

- Savings Spree: Game-based learning

Source: The Motley Fool