A stablecoin is a cryptocurrency that lives in an old-school currency environment with a value that is fixed or “pegged” to another currency.

As the federal fiscal year closed in September 2025 and debate raged about the next fiscal year and beyond, concerns categories include (but are not limited to:

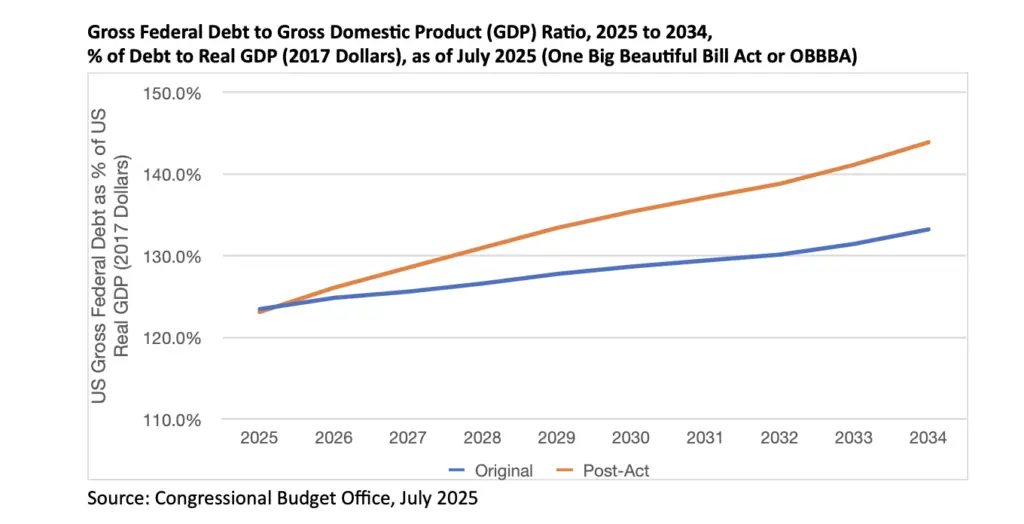

(1) the final budget creates larger federal fiscal deficits and debt

(2) additional tariff revenue will not be enough to reduce deficits

(3) projected deficits should have financial markets betting on more upward pressure on federal debt interest rates, especially longer-term Treasury notes.

The accompanying graphic (below) represents the latest (as of July 2025) projection by the Congressional Budget Office for the annual change through 2034, with respect to new federal debt entering the market. The federal debt-to-Gross Domestic Product (GDP) ratio is expected to increase as deficits create more debt during a time of slow economic growth. One implication of this progression is that by 2034, one in every six dollars of federal government revenue will be allocated to interest payments on the federal debt.

There may be a new (ish) way to pay down this debt (or at least find initial financing for it) through stablecoins. A stablecoin is a cryptocurrency that lives in an old-school currency environment with a value that is fixed or “pegged” to another currency (think of the latter-period gold standard, from 1944 to 1971). In many ways, a stablecoin (Ethereum is a good example) serves as a substitute for other cryptocurrencies, providing a means for users to transact in virtual markets that demand a cryptocurrency without the risk exposure associated with other cryptocurrency assets.

If a U.S. Dollar stablecoin (let’s call it USDS here) were adopted to qualify as a “stable” currency in financial markets, the Federal Reserve would need to set aside or print money to maintain a parallel account balance equal to the new USDS supply, thereby creating one-for-one support. The Federal Reserve would not have an incentive to hold such cash idle and would likely purchase Treasury securities. Once the demand for U.S. debt was triggered by a USDS adoption, the federal government could then issue debt to finance spending equivalent to the needs shown in the accompany chart, potentially matched by Federal Reserve demand, and thus have little direct impact on debt markets.

What a fantastic way to pay off loans! The short-term cost of issuing debt would fall. However, the entire cycle of new debt created above could be seen as financed by such an adoption, which also provides credibility to a medium of exchange that still has many questions around it and perhaps fuels wealth for those who have waited for such an adoption to reduce volatility to date and thus capitalize on that change in the long term.

The federal government has been debating the adoption of digital currency with crypto qualities for years. A solution is unclear because economists and policymakers are struggling with how a “digital” dollar may render the Federal Reserve the primary depository institution in practice within a few years after the USDS is adopted. What would happen to commercial banks, savings banks, credit unions and non-bank lenders if they were no longer primary in deposit markets, as consumers and businesses could hold digital/blockchain accounts with the central bank? We will consider that question in a future article.