NorthBay biz celebrates its 40th anniversary with a look at how the local banking and finance industries have changed over the years.

When Santa Rosa’s first bank opened its doors more than 100 years ago, it was an era of stagecoaches and dip pens. Clerks kept accounts in huge ledgers, and the thought of making transactions without ever touching a banknote or coin would have been pure fantasy. The world of finance has come a long way.

When Santa Rosa’s first bank opened its doors more than 100 years ago, it was an era of stagecoaches and dip pens. Clerks kept accounts in huge ledgers, and the thought of making transactions without ever touching a banknote or coin would have been pure fantasy. The world of finance has come a long way.1890: An auspicious beginning

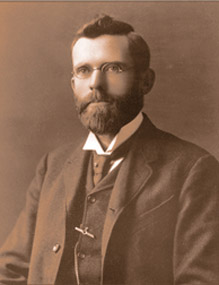

Prominent businessman Manville Doyle and his son, Frank, opened Exchange Bank of Santa Rosa in 1890 and, since then, it’s seen the turn of two centuries and weathered several major events, including the San Francisco Earthquake, the Great Depression and two World Wars. This year, it celebrates its 125th anniversary, a major milestone in the bank’s history.

Its first branch opened in Old Courthouse Square on May 1, 1890, with Manville Doyle as president. When the San Francisco earthquake struck on April 18, 1906, the number of banks in town had grown to four, and the temblor destroyed all their buildings. “It devastated about 90 percent of Santa Rosa,” says today’s president, Gary Hartwick. Nonetheless, Manville brought the four banks together in a cooperative effort and they opened four days later—all at the same time so no one would have a head start. “The goal was to help people. They provided handshake loans to the businesses in this community,” says Hartwick, who further notes that, after the earthquake, Doyle helped set up a note system to replace national currency until the banks could reopen.

Frank Doyle became the bank’s second president in 1916 and, during his tenure, a second branch opened in Windsor in 1925 and a third in Cotati in 1941. He was involved in the founding of the Santa Rosa Chamber of Commerce, the building of Redwood Highway and in securing the interest and financing for building the Golden Gate Bridge (he dedicated 10 years of his life to this last project). “The legacy and history is just amazing,” says Hartwick. “Frank Doyle was a true visionary leader and an iconic figure in our community.”

Frank Doyle became the bank’s second president in 1916 and, during his tenure, a second branch opened in Windsor in 1925 and a third in Cotati in 1941. He was involved in the founding of the Santa Rosa Chamber of Commerce, the building of Redwood Highway and in securing the interest and financing for building the Golden Gate Bridge (he dedicated 10 years of his life to this last project). “The legacy and history is just amazing,” says Hartwick. “Frank Doyle was a true visionary leader and an iconic figure in our community.”Charles Reinking became president in 1948 and, under his leadership, the bank began to change as a result of the post-World War II boom in the economy. The first drive-through bank opened in the 1950s, and several more offices opened in Sonoma County, with expansion continuing into the 1970s. In 1986, C. William (Bill) Reinking became president, and Hartwick points out that the bank has had only eight presidents—four from two families, the Doyles and the Reinkings.

Doyle leadership ended with Frank’s passing in 1948, but the family’s values endure. “One of the special missions of this bank is its dedication and commitment to the community. This special mission was given to us by Frank Doyle,” says Hartwick. In 2014, the bank supported more than 200 nonprofit efforts and donated in excess of $600,000. “That’s the legacy, the mission of the original founders,” he says, observing that all banks sell the same products and services: “What differentiates us is our rich history, legacy and our dedication to the communities we serve.”

1950s: A cooperative effort

In the 1950s, the economy was on an upswing and the country was thriving. Even in prosperous times, though, people can have financial challenges, and several Sonoma County employees were feeling the pinch. In 1950, seven of them banded together to create a financial cooperative called the Sonoma County Employees Credit Union and give each other loans. They operated from the Sonoma County Auditor’s Office until 1967, when they opened their first branch. In 1982, to accommodate the community’s increasing demand for its services, the former SCECU became Redwood Credit Union and opened membership to anyone living or working in the area.

Since then, “We’ve expanded into a community charter in eight counties,” says President/CEO Brett Martinez, adding that RCU is five times bigger in size than it was in 2000. During the recent financial downturn, RCU continued business as usual—helping members manage their money—and it now has 240,000 members, 17 locations and $2.4 billion in assets, “It’s pretty substantial growth,” he says. “We’re very safe, very sound and in the best financial position we’ve ever been in our history.”

Philanthropy has grown with the business and, in 2014, RCU contributed to 140 events and employees gave 3,200 volunteer hours. “With our growth and success, we’ve been able to do a lot more,” says Martinez. “Our business model is to help people, not profit from them. We really appreciate our community.”

1970s: Mergers and acquisitions

In 1973, three local banks—Bank of Marin, Bank of Sonoma County and First National Bank of Mendocino County—formed Independent Bankshares Corporation. In 1983, it merged six banks to launch Westamerica Bank, which grew to 57 branches by 1995 as a result of several acquisitions, including Napa Valley Bancorp and North Bay Bancorporation. By 2005, the bank completed mergers with First Counties Bank, Kerman State Bank and Redwood Empire Bancorp. In 2009, Westamerica Bancorporation, Westamerica Bank’s holding company, acquired County Bankfrom the Federal Deposit Insurance Corporation, gaining $1.6 million in assets and 39 branches. In 2010, it purchased the assets and assumed the liabilities of Sonoma Valley Bank. Today, it’s a regional community bank with more than 90 branches and two trust offices in Northern and Central California.

One of Westamerica’s goals is improving the quality of life in the communities it serves. Among its efforts, it makes financial contributions to worthy causes and, in 2014, it donated a building it no longer needed in Point Arena to Action Family Resource Center.

In 1975, farther afield in Butte County, the agricultural market was in trouble and banks were being selective in providing funding. Local farmers and businesspeople thought they were being unfair, so they started their own bank. From its first branch in Chico, Tri Counties Bank expanded to Glenn and Shasta counties. In 2014, it acquired North Valley Bancorp and its branch in Santa Rosa. “Sonoma County was a real nugget in the transaction,” says President/CEO Rick Smith.

Smith says that Tri Counties Bank exists for only one purpose: improving the financial success and well being of shareholders, customers, communities and employees. “We try very much to balance our constituents. At the core, that’s what a community bank is extremely good at,” he says. He reports that Tri Counties has the largest market share in Chico, exceeding the bigger banks. “It’s a demonstration of what a community bank can do when it’s fully engaged,” he says. “I believe in staying connected and knowing your customers well,” he adds, explaining that sometimes that requires saying no when it’s not in the customer’s best interest to extend a loan.

He finds that the biggest change for customers in the last four decades is automation, beginning with ATMs. He acknowledges that the Internet makes banking easier, but says, “We still believe in bank branches.” So far, Santa Rosa is the only branch in the North Bay, but, says Smith, “We’d love to open more.”

Although Tri Counties is small and new to the area, he anticipates outreach. “We do it because it’s part of our DNA,” he says. “Traditionally, we like helping families and kids.”

Meanwhile, 2015 is Tri Counties’ 40th anniversary, and “It’s a big moment,” says Smith.

1980s: Finding focus

1980s: Finding focus

Santa Rosa-based Summit State Bank started as a savings and loan in 1984 and later became a full-service community bank. “We’re a commercial bank that supports local, small businesses that build and strengthen the Sonoma County economy,” says President/CEO Tom Duryea.

Among the hurdles Summit State had to overcome to change its business model was replacing certificates of deposit with relationship-based core deposits to increase and sustain its lending into the Sonoma County community. Its continuing strong performance means it’s been able to provide increasing support to many nonprofit partners. “This program has been very robust and now supports more than 140 local nonprofit partners,” says Duryea, adding that San Francisco Business Times named Summit State Bank one of the top 75 corporate philanthropists in the Bay Area in 2013 and 2014, putting it in the company of eBay, Oracle, Levi-Strauss and Google.

“As one of only two Sonoma County businesses to be recognized, we’re quite proud of this recognition,” says Duryea. “It reflects the deep commitment and spirit of our Summit team.”

“Our thrust right now, as part of our small business lending program, is to support our community’s small businesses that help sustain our community,” says Duryea. The bank has $100 million available to assist small businesses and commercial real estate borrowers. Duryea further explains that, because Summit State is small and local, it has the ability to respond quickly to requests: “We’re more nimble. You can meet with and have direct access to the person who’s handling your loan.”

In January, Summit STate Bank welcomed Brandy Lee Seppi, a Healdsburg native, as CCO.

Summit State Bank supports nonprofit organizations and projects, including Sonoma County Community Child Care Council and Valley of the Moon Children’s Foundation. “The money the bank lends goes back into Sonoma County’s economy to strengthen small businesses that support families and provide growth and advancement opportunities for their employees,” says Duryea. “The best example is our customer, Oliver’s Market, one of this community’s most successful and iconic brands.”

As banking expanded and customers prospered in the 1980s, money management became increasingly important. In 1984, Certified Financial Planner Bruce Dzieza, who was also a real estate agent, opened Willow Creek Wealth Management in Sebastopol. “He wanted to do something a little different than real estate,” said Jason Gittins, CFP, an adviser and partner, who’s been with the firm for 18 years.

The company navigated the technology bubble from 1997 to 2000, as well as the recession in 2008, and “We got through and validated our business model and solidified what we do for our clients,” says Gittins. He points to two significant changes in the business since 1984. “Investing is turning into more of a science than an art,” he says, explaining it now has more rules and is more evidence-based. These days, he observes, advisers are consulting on all financial matters as well as investing clients’ money, so the company’s seven advisers are all well qualified, with credentials as Certified Financial Planners and at least 10 years of experience.

Technology has also changed the way advisers work. “We can do so much more for our clients,” says Gittins, recalling that he used to fill out forms in triplicate and then fax them to a trading desk. Now Willow Creek has an internal trading group that executes trades in seconds using a computer. The biggest change, however, has been in the way clients think about investments. “People want transparency through and through,” he says. They want to know what they’re paying for and are seeking low-cost services, liquidity, ease in getting out of an investment and safety. He sees a nationwide movement toward using index-based mutual funds, and a trend toward fee-based instead of commission-based services. “It’s definitely a trend that’s gaining steam,” he says.

Willow Creek believes in supporting the community, and its staff members volunteer, assist with fund-raising and help nonprofits develop strategies.

1990s and 2000s: Evolution and growth

Although its official founding date was in 1989, Bank of Marin opened its first two branches, in San Rafael and Corte Madera, on January 23, 1990; thus, this year marks its 25th anniversary in business. From those first two offices, it’s grown to 20 branches in Marin, Napa, Sonoma and Alameda counties and San Francisco.

Although its official founding date was in 1989, Bank of Marin opened its first two branches, in San Rafael and Corte Madera, on January 23, 1990; thus, this year marks its 25th anniversary in business. From those first two offices, it’s grown to 20 branches in Marin, Napa, Sonoma and Alameda counties and San Francisco. Fabia Butler, vice president and manager of community and public relations, describes the bank’s growth as organic. “We saw our customers migrating north,” she explains, so the bank expanded to Petaluma first. In 2011, Bank of Marin acquired Charter Oak Bank in Napa, as an FDIC-assisted transition and, most recently, it acquired the Bank of Alameda. “That was our first true acquisition,” says Butler. “In all likelihood, we’re going to continue to grow,” she says.

Fabia Butler, vice president and manager of community and public relations, describes the bank’s growth as organic. “We saw our customers migrating north,” she explains, so the bank expanded to Petaluma first. In 2011, Bank of Marin acquired Charter Oak Bank in Napa, as an FDIC-assisted transition and, most recently, it acquired the Bank of Alameda. “That was our first true acquisition,” says Butler. “In all likelihood, we’re going to continue to grow,” she says.She observes that banking has changed, so clients have choices and don’t use the branches as much. “Way back when, ATMs were a big deal. Now people have mobile devices,” she says, adding that the bank makes sure it offers all the options.

Bank of Marin Bancorp, the bank’s holding company, is listed on NASDAQ, and a major milestone came when its stock reached $52.73 per share in November 2014. Many of its shareholders are local, some of who were among the original shareholders in 1989 (all Bank of Marin employees are shareholders as well).

Bank of Marin’s philanthropy is extensive, and it’s had a longstanding partnership with Book Passage in Corte Madera, displaying books in its branches and cosponsoring events to help raise money for charity. Bill Murray was the bank’s founder and, says Butler, “One of his values was to always give back to the community. It’s a value that will always stay with us.”

Global Wine Partners, a wine industry investment bank in St. Helena, started as MKF (Motto, Kryla & Fisher LLP) in 1982, when three partners with a passion for wine and business launched a CPA and consulting firm to serve the wine industry. Mike Fisher and Vic Motto became increasingly involved in merger and acquisition advisory work and, in 2003, they formed an investment bank called Global Wine Partners. “It’s the only investment bank dedicated to the wine industry,” says partner Carol Collison.

Global Wine Partners, a wine industry investment bank in St. Helena, started as MKF (Motto, Kryla & Fisher LLP) in 1982, when three partners with a passion for wine and business launched a CPA and consulting firm to serve the wine industry. Mike Fisher and Vic Motto became increasingly involved in merger and acquisition advisory work and, in 2003, they formed an investment bank called Global Wine Partners. “It’s the only investment bank dedicated to the wine industry,” says partner Carol Collison.Collison reports that the business in mergers and acquisitions has been steady. “It’s a pretty organic process. We experience cycles like everyone else,” she says. The economic downturn in 2009 and 2010 was challenging, because it was difficult to find buyers. “Most normal buyers were understandably cautious,” she says. However, activity increased in 2011 during the recovery from the recession, and “Now we’re back to normal,” she says.

The company has grown with the wine industry, and “We’ve become better at what we do,” says Collison. “Our principals were there at the creation of Napa Valley Vintners and the creation of the Culinary Institute of America at Greystone [in St. Helena],” says Collison, adding that, although the company isn’t directly involved in philanthropy, its members contribute to nonprofits individually.

Money might make the world go around, but friendship and caring play a role, too. Outreach is one of the local finance industry’s strengths, and it reflects a belief in the importance of the people in the community and a desire to make their lives better. Add those values to good business practices, and that just might be the secret to success.

The Frank Doyle Legacy

1922: Frank Doyle and his wife, Polly, deed 22.5 acres to the city of Santa Rosa for Frankie Doyle Memorial Park, now Doyle Community Park, after their 13-year-old son dies.

1923: Doyle is instrumental in creating the Bridging the Golden Gate Association.

1930: Doyle helps get a $35 million bond passed to build the iconic bridge.

1937: Doyle, known as “Father of the Golden Gate Bridge,” cuts one of three chains with a blowtorch to officially open the bridge and drives one of the first cars across. Doyle Drive is named for him.

1948: Frank Doyle dies, leaving his 50.4 percent controlling interest in the bank in a perpetual trust. The trust receives dividends from the bank, with $2,000 per year designated to the maintenance of Doyle Community Park, and the balance going to the Doyle Scholarship Fund to help students attend Santa Rosa Community College. So far, $80 million has made it possible for 120,000 students to attend SRJC.

Finance Industry Timeline

1890: Exchange Bank of Santa Rosa is the city’s first bank.

1950: Seven Sonoma County employees establish a cooperative that eventually becomes Redwood Credit Union.

1967: Sonoma County Employees Credit Union opens its first branch.

1973: Bank of Marin, Bank of Sonoma County and First National Bank of Mendocino

County form Independent Bankshares Corporation.

1982: Sonoma County Employees Credit Union becomes Redwood Credit Union.

1983: Westamerica Bank forms through a merger of six banks.

1984: Summit State Bank opens as a savings and loan.

1984: Willow Creek Wealth Management opens.

1990: Bank of Marin opens its first two branches.

2003: MKF and International Wine Consultants merge to become Global Wine Bank.

2014: Tri Counties Bank opens its first branch in Sonoma County.