Husband-wife team Beth and Chris Vecera own and operate Naysayer Coffee Roasters.

Creative thinking, federal loans, digital advertising, and state and local grants are helping North Bay small businesses through one of their most challenging eras. As many businesses close their doors for good due to the pandemic, surviving companies have developed side ventures into full-fledged operations. They are relying on the internet and word of mouth to share their stories.

Additionally, it’s been vital for small businesses to keep track of a shift in consumer patterns caused by unprecedented times, according to Robert Eyler, Ph.D., professor of economics at Sonoma State University. “[Consumers] have gravitated toward activities and purchases related to the home—popular goods and services related to virtual events, in-home entertainment, to-go dining, paying down debt on property, landscaping, construction and home repair,” he says.

The pandemic toll

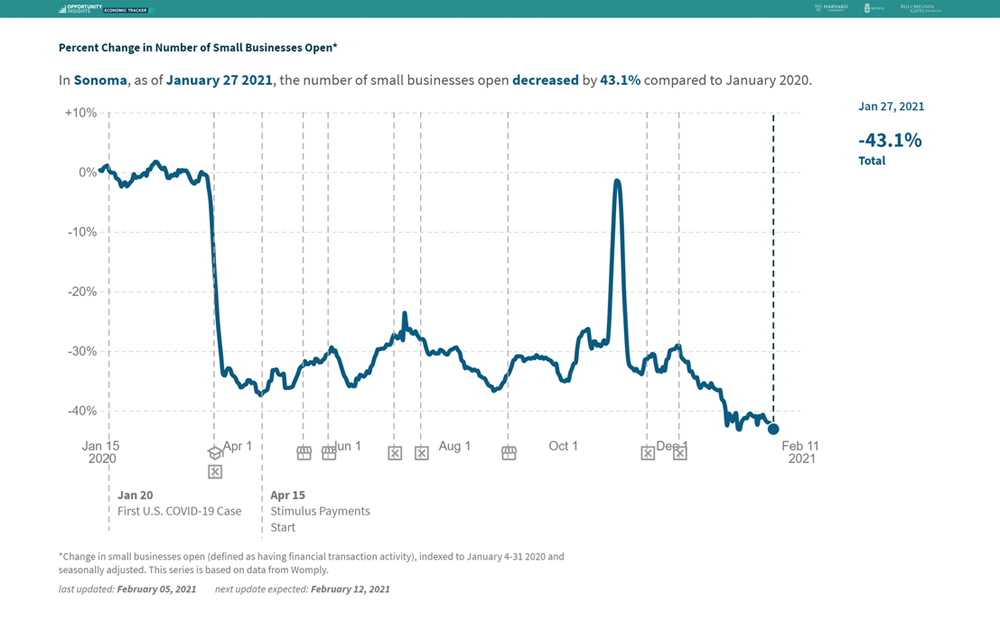

The toll from the pandemic has resulted in a 33.6 percent drop in the number of small businesses nationwide, according to statistics from Opportunity Insights, a nonprofit, nonpartisan group at Harvard University dedicated to tracking the recovery. Yelp’s local economic impact report from September 2020 translates the percentage to a closure of 163,735 small businesses on Yelp. Opportunity Insights’ data show the San Francisco Bay Area has been hit especially hard, with small-business closures almost twice the rate of the national median.

One of the reasons that small businesses are suffering is because consumer spending power has decreased. The California unemployment rate in December last year was 9 percent. In December 2019, before the pandemic hit, it was 3.9 percent, according to data from the California Employment Development Department.

According to Eyler, businesses that could not move their operations outside or online have seen the most severe impacts. “These businesses involve a gathering of people, people in close quarters, travel, or a combination of these factors,” he says.

Such businesses include restaurants and caterers, the hospitality industry, retail stores, florists, sports and recreational activities, music and other arts, transportation, event planners, theaters, and non-acute health care, according to Eyler and a June publication by the McKinsey Report. Eyler says manufacturing is holding steady. Finance and real estate-related businesses are stable, partly because low interest rates are fueling lending.

Several businesses interviewed for this article added it has been hard to find qualified employees for in-person positions. Older adults who have not received the vaccine are concerned about their safety. Parents and adult siblings must care for students learning at home.

City and county governments are stepping up by working with local chambers of commerce, sharing best practices for operations, offering clarifications about rules, and providing funding.

The business development team at the Sonoma County Economic Development Board has assisted almost 1,000 businesses since March, says Sheba Person-Whitley, executive director. “EDB had $2.5 million in grant funding from the Coronavirus Aid, Relief, and Economic Security (CARES) Act,” she says. “We provided this to struggling business owners and entrepreneurs who want to start businesses [and] needed access to capital in forms other than debt. We also did a comprehensive survey early on in the pandemic to tailor our programs,” says Person-Whitley.

Sonoma County EDB has placed an emphasis on supporting minority business owners and entrepreneurs. The pandemic has had a disproportionately-greater negative effect on Black and Latino communities, according to health-related data from the Centers for Disease Control and Prevention and unemployment and financial data from the Economic Policy Institute and the Pew Research Center.

Undocumented immigrants have suffered even more hardships. They are ineligible for unemployment insurance and very limited in their abilities to apply for Payroll Protection Program (PPP) loans and Economic Injury Disaster Loans (EIDL), according to a May 2020 report from the Congressional Research Service.

Marcos Suarez, program manager of business diversity services for the Sonoma County EDB, says the agency is using every medium to reach out.

“We’re connecting to business owners and entrepreneurs through phone calls, email, social media, radio, television and Zoom meetings. We’ve been providing safe, masked and socially distanced in-person assistance related to funding and COVID-19 safety, especially in remote and underserved areas like the Lower Russian River, Sonoma Valley and Cloverdale. We’ve visited areas with a high amount of Latinx businesses and customers, like Roseland, to talk about what help they need and the concerns they have. We’ve also appeared regularly on radio shows, including the one for Exitos 98.7 FM, and other Latinx radio stations. Further, we’ve collaborated with the Sonoma County Hispanic Chamber of Commerce and other organizations that serve our underserved businesses to increase outreach,” says Suarez.

“Although we saw some residents and business owners leave during 2020, we also saw many new residents and business owners come north from other parts of the Bay Area. We have never been busier.” — Sheba Person-Whitley, executive director, Sonoma County Economic Development Board

Person-Whitley says the effort to help small businesses did not stop during the fall 2020 fires. “EDB also offers disaster assistance and information related to disaster recovery. Although we saw some residents and business owners leave during 2020, we also saw many new residents and business owners come north from other parts of the Bay Area. We have never been busier,” says Person-Whitley.

Lessons in pivoting

During the pandemic, “pivoting” can mean everything from establishing an online presence to offering different products.

Ben Koenig, co-owner of Heritage Eats in Napa, says he, his wife, Ali Koenig, and their business partner, Charles Whittaker, have come up with many new ideas. They opened Haven Napa, an online-only wings restaurant and purchased a new food truck, which they branded the Best Food Truck Ever. This will allow them to travel to business districts and the Napa Farmers Market. They also provided grocery deliveries when the shelter-in-place order was in effect last spring.

“When the first shutdown orders came in spring 2020, it didn’t feel fair or right for us to close. We’d been in business for five-and-a-half years. Shutdown orders were constantly changing the landscape. Ali, Charles, and I sat down and figured out several different ways to keep our team employed and Heritage Eats open,” says Koenig.

Carrie Saxl, co-owner of Guild, a maker workspace, event venue and retail store in Napa, says she and co-owner Monica Stickley stayed in business by creating kits that can be purchased online and made at home. “We’ve also created crafts for adults and offered virtual workshops for children and adults. We’ve held in-person, safe, and socially-distanced craft classes and camps for children at Guild, both outside and inside, sold retail goods online at Guild’s store, and brought craft kits and retail goods to sell at a booth at the Napa Farmers Market.”

Per Saxl, the huge need for children’s programming led Guild to offer four-hour morning and afternoon weekday programs. “Our afternoon sessions have had a wait list since August. Despite this good news, we have had to work through obstacles, from overcoming difficulties with sourcing certain supplies to hiring additional staff and establishing COVID-19 safety measures.”

Gustavo Martinez, owner of Paradise Sushi, which has four locations across Santa Rosa, Rohnert Park, and Petaluma, says in the early days of the pandemic, business dropped to the extent that he had to let go 30 percent of his staff. “Later on, we prepared for outdoor dining, even though we had to stop it temporarily during the holidays. We spent money to get a tent and heaters.” Since such costs relate to new expenditures, they are not covered by PPP and EIDL loans.

Martinez says Paradise Sushi also transformed its all-you-can-eat-sushi offer to a $28 to-go special for four sushi rolls and a miso soup and salad. It advertised this special on social media, including Facebook and Instagram. “Once we developed this and other specials, we started seeing a lot more orders. We partnered with delivery services, including DoorDash, GrubHub and Uber Eats. They take a huge percentage of our revenue, but help increase the number of orders,” says Martinez.

Serena Harkey, director of wine for Left Bank Brasserie in Larkspur, says after the restaurant made the difficult decision to temporarily close in March 2020, management found it important to take the opportunity to regroup. “We then came up with a number of ‘restaurants within a restaurant,’ virtual concepts to increase the number of guests we could reach. Now diners can choose from traditional French cuisine from Left Bank Brasserie, different mac n’ cheese dishes from the Mac n’ Cheese Shop, Meditteranean favorites from Skewery by Meso, and Mexican meals from Lito’s Cucina, all available through third-party ordering from Left Bank,” says Harkey.

In addition, Left Bank created weekly family dinners and partnered with Kentfield Schools Foundation (KIK) and Larkspur-Corte Madera Schools Foundation (SPARK). A portion of the proceeds from family meals go to schools in these districts, according to Harkey. “It helped for us to limit our menus a bit so we could control purchasing. We asked for feedback on what dishes would be the best. Our big hits this winter were French comfort foods like Beef Bourguignon and Coq au Vin.”

Increasing business during a pandemic

It’s key to be available to customers and help them feel safe and welcome. Carolina Jurovic, manager of Pippa Small Jewellery in Larkspur, says the London-based company took time to figure out to do that after its initial opening in late February last year. “When the shelter-in-place orders came, we shut down immediately. We hadn’t even set up a mailing list yet,” she says.

In August, with the support of the property management team at Marin Country Mart, Pippa Small reopened. They were fortunate to be in a center where bathrooms were cleaned often and signs encouraging mask wearing were in every store window. “Safety is a significant factor because the store is 10 feet by 10 feet. Now, even when it is cold outside, I leave the door open, for air flow and to welcome guests,” she says.

When outdoor dining resumed, she noticed couples checking out the store before their dinner reservations were called. “I decided to stay open later, until 7 p.m., so guests could come around dinnertime,” says Jurovic.

She adds that creating a Marin-centered Instagram account is helping the store build a following. “Having a local voice to share what was available in the store is working. We also send mailers that are specific to the Marin location.”

Jurovic says talking about Pippa’s journeys, particularly her work with the Turquoise Mountain Foundation, which has helped revive traditional arts and crafts in Afghanistan, has drawn in customers who want to support traditional artisans and miss traveling.

“I’ve noticed a lot of interest in ethically-sourced pieces recently. People’s hearts have grown during the pandemic,” says Jurovic.

“When [brick-and-mortar] stores closed, more people began shopping for clothes online. I almost doubled my income.” — Kristy Lewis, owner of The Bee Chic Boutique

Kristy Lewis, owner of The Bee Chic Boutique in Sonoma, says her online-only business is experiencing an unexpected boom.

“When [brick-and-mortar] stores closed, more people began shopping for clothes online. I almost doubled my income,” says Lewis, adding that Facebook Live sales are extremely helpful. She uses them to model the clothes so customers can ask questions in real time. Shipping times are slower than before the pandemic, says Lewis, but sales of comfortable items like loungewear are up.

Beth Vecera, who co-owns Naysayer Coffee Roasters in Napa with her husband, Chris Vecera, says the pandemic drastically changed their business model. “We used to sell to a number of restaurants and wineries in Napa Valley. When those businesses temporarily closed last spring, local grocers really saved us. These included Browns Valley Market and Hudson Greens & Goods, both in Napa, Cal Mart in Calistoga, and Sunshine Foods Market in St. Helena,” says Vecera.

Naysayer also teamed up with Toasted Napa, a local bagel shop, to deliver coffee and bagels to health-care workers.

“This allowed us to serve local frontline workers, increased visibility, and brought in new customers. In summer, we developed our ‘Sizeable Latte,’ an extra large latte in 32-ounce bottles. By that time, we had become a home-delivery company, offering free local delivery of drinks and beans to Napans. In December, we added a mobile espresso cart at the First & Franklin Marketplace in downtown Napa,” says Vecera.

Naysayer also offered coffee drinks and beans at the St. Helena Farmers Market and Napa Farmers Market. It partnered with Clif Family Winery to create the Clif Family Holiday Blend.

“We have bags of beans, coffee subscriptions and brewing equipment all available online at the Naysayer website. The online store has been keeping us busy. It helps that Napa has a deep love for everything local,” says Vecera.

How to get help

The Napa-Sonoma Small Business Development Center and the Marin Small Business Development Center are available to support small-business owners looking for pandemic-related funding such as PPP and EIDL loans, and state and local grants. The centers are offering webinars, counseling and referrals to lenders processing loan applications.

“The Napa-Sonoma Small Business Development Center can work with business owners to improve their credit and better manage their cash flow during these hard economic times. We can work with them on analyzing their financials, looking for areas of financial stress factors. [We are there to] recommend a plan on reducing these stress factors,” says Mary Cervantes, director of the Napa-Sonoma Small Business Development Center. She says the Napa-Sonoma SBDC can also assist with ensuring a website is user-friendly for online shoppers, which is particularly important for older, established businesses. “It’s most important to keep the customer experience in mind as the website becomes the main point of entry. Businesses need to develop a strategic social-media campaign to drive customers to their website. This takes planning,” says Cervantes.

Miriam Hope Karell, director of the Marin Small Business Development Center, says the Marin SBDC has a team of loan and grant experts ready to assist in submitting applications. They can assist small businesses by answering questions about funding and discussing pivoting strategies. The team is further available to respond to questions about human-resource issues and online advertising and sales. “It is important to have a live person to talk to right now. They help assuage confusion and make an application successful,” says Karell.

According to Karell, the Marin SBDC is currently receiving hundreds of requests from businesses needing guidance. It is also part of county groups to help launch and support other grant and loan programs to assist local businesses. She adds that the Marin SBDC has become a key source of information on latest updates to funding programs for county offices and business organizations. “We will continue to create new programs as needed to serve as many businesses as possible.”

Negotiating rent can be a key way to relieve stress, says Steve Crane, principal broker at Morley Fredericks Real Estate Services in San Rafael.

Crane primarily represents commercial and residential landlords as well as some commercial tenants. He says a landlord is more likely to grant a request when a tenant can demonstrate a loss in revenue. “It also helps to have a landlord visit a property to see the amount of business coming through the door. If that doesn’t help sway them, a broker can help a tenant relocate to a new location with a lower rent,” says Crane.

Crane is concerned that a number of commercial landlords are struggling to pay their mortgages. “We’ve had several ridiculously low offers to lease some commercial spaces. Many prospective renters, and buyers, don’t have a detailed plan for what they want to do with a property. They’re just seeing if they can lock up a site at a price they consider to be a steal,” says Crane.

Crane says he is responding by putting all listings online. “This cuts down on calls. It also allows us to communicate the details of an offering and the degree to which a landlord is willing to be flexible,” says Crane.

Virtual 3-D tours, filmed with a Matterport camera, says Crane, have also helped close deals. “When a client demonstrates they are serious, we’ll schedule an appointment for them to tour the space in person. The space has to be vacant. We no longer hold open houses because of safety issues.”

Crane says since his agency has fewer in-person showings, he does a lot to prepare a property for viewing. “I’ll come early, open all the doors and windows, turn on all the switches, from lights to heat, and step outside while they tour. People respond to that. They respect that you care about their safety.”

Crane has seen different patterns for commercial occupancy in Sonoma and Marin counties. “Marin is seeing a lot of turnover. A lot of people from San Francisco have moved to Marin. Yet a lot of long-time Marin residents and businesses have left Marin as well. In contrast, in Santa Rosa, tenants are staying,” says Crane.

His tip for small businesses is to still consider some traditional old-school advertising mediums. “If an owner has the budget, they should consider advertising in neighborhood magazines, joining the Better Business Bureau, and becoming a member of their local chamber of commerce,” says Crane. “They’re finding people in their communities are paying attention to these directories. Customers want to support local businesses. They now have time to learn which businesses are close by and deserve their support.”

A Second Round of PPP

Small businesses can now apply to receive a “second draw” of funding through the Payroll Protection Program (PPP). The “first-draw” portion of the program reopened Jan. 11, while the second-draw portion opened Jan. 13. The application deadline is March 31.

A first-draw participant is typically required to have 500 or fewer workers. There are “small business concern” and “alternative size standard” exceptions to this rule. A first-draw participant’s loan limit is 2.5 times their average monthly payroll cost. A second-draw participant is typically required to have 300 or fewer workers. Second-draw participants must demonstrate a 25 percent reduction in gross receipts between comparable quarters in 2019 and 2020.

Business owners should get started early. The U.S. Small Business Administration and Treasury are likely to take more time to screen applicants than before.

North Bay businesses can receive help with applications for PPP loans, EIDL loans, and other pandemic-time funding options from their county’s small business development center, said Miriam Hope Karell, director of the Marin Small Business Development Center (SBDC).

“For borrowers looking to get a PPP loan, it is best to first go to their bank, especially if they are looking for a second draw PPP loan. If a bank is not an option, the SBDC can assist with finding the best lenders that have been successful for other clients,” says Karell, adding that there are many nuances with the PPP applications and the language related to loan forgiveness.

“It is best for business owners to reach out for guidance,” she says. “We have helped over 1,600 businesses with PPP, EIDL, and other types of funding. We are ready and able to support you. Don’t hesitate to reach out. We are there for you.”