Now that we are in 2024, we look forward to a year of elections (local, state, federal with a side of presidential) and turmoil across the globe. I want to provide my view on the California and American economies as context for the North Bay, and some thoughts about what to expect through 2025 once the election dust has settled (at least in theory).

Macroeconomists think about four major markets: (1) labor markets; (2) goods and services markets, or how we produce and sell goods; (3) financial markets driven by how money is saved; and (4) how the dollar performs as a foreign currency. Labor markets remain strong at the national level, with a hint of fading. For California, 2023 had been a year of hiring growth for employers alongside of little-to-no growth of Californians with a job (Figure 1).

Hiring continues for people that live outside California. For the North Bay, we are still waiting for regional labor-market recovery from the pandemic’s shock (we are still not back to pre-pandemic levels as of October 2023), primarily due to a mix of people that have left the area and retirements that reduced the regional labor force.

The way we produce goods and services has slowed since 2022 as interest rates increased. Commercial real-estate markets remain unstable as employers wrestle with back-to-office decisions. Industrial and warehousing space is basically full. New construction has increased a bit for commercial spaces, while residential construction has begun to sag. Interest rates rising has shifted returns for both landlords and homeowners. Developers are seeking relief in the face of aging populations and higher costs to build. Construction does not happen with profit incentives to build.

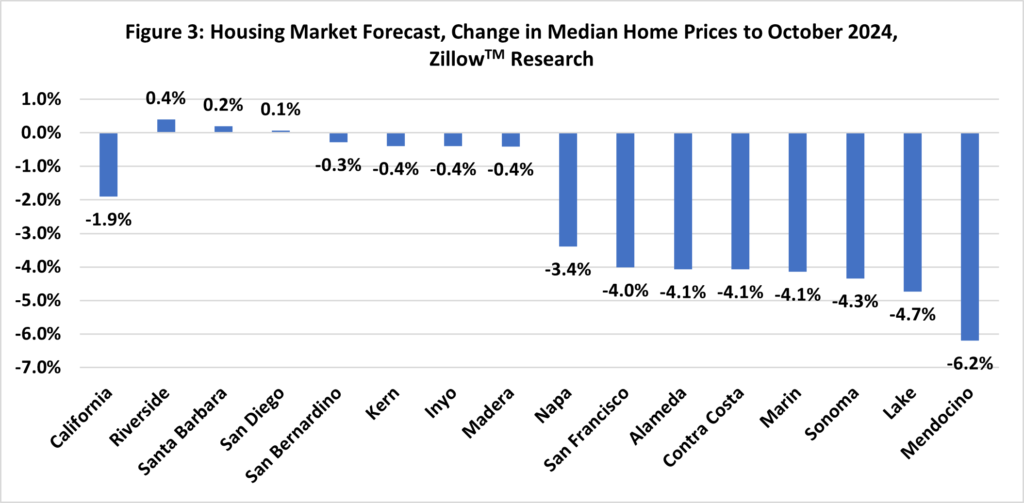

Interest rates rising are classic headwinds in macroeconomics. Financial markets do not like rising rates: costs to borrow increase and the valuation of assets fall because demand runs toward interest-bearing assets (like savings accounts) and commodities that may be seen as fighting inflation’s erosion to wealth, such as gold. The Federal Reserve is now fighting inflation directly, aiming for inflation close to 2% per year; this is the current, “target” inflation rate. The Federal Reserve is not beholden completely to this target, but interest rates should not move down in earnest until inflation is closer to that target with the unfortunate byproduct of a slower jobs market. Housing market forecasts (see Figure 3) are a way to monitor how investors and homeowners see residential real estate as a good (or not) investment in the future.

With higher interest rates and slow-and-steady growth for the United States, global finance is drawn toward the U.S. financial markets and the dollar. The American government’s debt has averted general, perceived risk somewhat. The presidential election in 2024 may exacerbate risk, especially on the back of Congressional issues with passing a federal budget.

In summary, 2024 is likely to be driven by five main issues to watch closely. These set the stage for the rest of this decade in many ways due to the pandemic’s shadow remaining above our regional economy:

- Interest rates will remain elevated in 2024, but a descent should begin by Q3 or Q4 2024;

- North Bay housing markets are likely to see prices fall a little in 2024, as labor markets and housing markets move slowly through 2024 with more pessimism than optimism;

- The North Bay is likely to see stress in commercial real-estate markets due to long-term headwinds, stress on lenders and rising occupancy rates;

- Napa County remains a shining star in this region due to tourism markets coming back from the pandemic, which support rising wages and local business revenues;

- Sonoma, Marin and Napa counties are aging and populations are lower; economic development efforts need to think creatively about next steps in industry diversity, higher education as a training partner, and how this region plans for 2030, which is just around the corner.