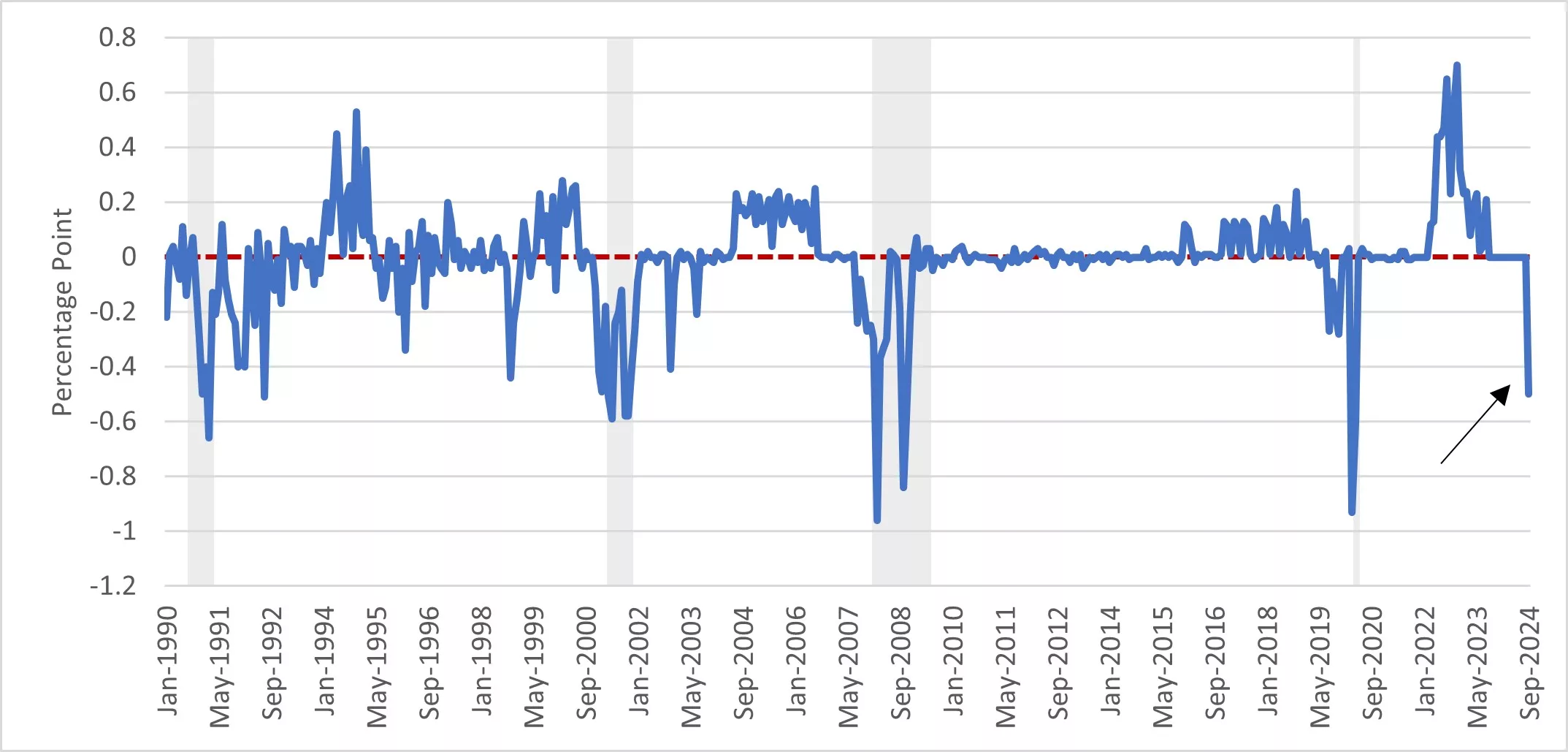

Percentage Point Difference, Monthly, Effective Federal Funds Rate, Jan 1990 to Sept 2024. Source: FRED Database (https://fred.stlouisfed.org/searchresults/?st=effective%20) and Author's Calculations. Shaded Areas = Recessions

When the Federal Reserve announced it was lowering its policy rate (what is known as the Federal Funds Rate) on Sept. 18, it surprised markets a little bit (not a lot) by doing what is known as a “jumbo” cut of 1/2 of 1% or 50 basis points. The standard change is 0.25% or 25 basis points in either direction. When the Federal Reserve changes its policy rate by more than the standard change, it sends a signal through financial markets of a need to help (cuts) or slow inflation (increase) quickly. The data below show that since 1990, when the Federal Reserve was more aggressive with cuts, recession is already here or is seen as coming soon. The black arrow is what happened in September 2024, the recent “jumbo” cut.

Financial markets generally predicted the more significant cut. The Chicago Mercantile Exchange (CME) has a tool to track how the market for buying and selling short-term bank debt between banks (Federal Funds) is pricing the potential of a future change in the rate of interest on such loans based on predictions of Federal Reserve Policy. This tool charts the way investors see a small cut (the right column) or a larger cut (the left column) and the probability of each scenario based on market activity. Generally, we should expect the Federal Reserve to cut its rate again at least one more time in 2024 and perhaps four times in 2025. The CME tool is publicly available at cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html.

Why was a jumbo cut used? Labor markets in the United States (where California is a microcosm of this concern) have been showing signs of slowing down but not necessarily shedding jobs rapidly. The slower pace of change suggests, alongside receding inflation rates, that the Federal Reserve had a license to reduce its policy rate and make the cost of short-term loans less. This action also helps continue to re-shape the basic profitability in lending; mortgage rates have been slowly falling since their peak in 2023, and reducing the Federal Funds Rate should help lenders’ costs of funds (it also, unfortunately, reduces the interest rate on simple savings accounts you may have been enjoying since the Federal Reserve increased interest rates in 2022 and early 2023). All those forces conspired to allow a big cut. Personally, I thought a succession of classic rate cuts (say, six of the next 10 meetings, which would take us to the end of 2025) would achieve a similar monetary stance without big swings.

However, it is really about where we go from here, as the figure above shows. Once cuts begin, it signals more change and generally choppier water ahead. Financial markets believe more rate cuts are coming as the Federal Reserve looks to guide American credit markets back toward a medium-term stability point after all the volatility during and after the pandemic. There were three rate cuts in 2019, as a slower economy was predicted in 2020 (see graph). The Federal Reserve is trying to shape expectations—what the jumbo cut does is signal to the world that American inflation is no longer as significant a threat to incomes and wealth as it was two years ago. The intent now may be more about helping stabilize labor and credit markets as the priority. It is unlikely we will see another jumbo cut in this cycle short of an emergency need (some economic calamity unforeseen by economists that necessitates quick financial change), but we are now searching for where policy rates will find their next resting space. Will we or will we not soft land? That is now the big economic question.