As we exit the 2024 election season and calendar year, we look forward to 2025. Economists are updating and pushing out forecasts for 2025 and beyond. The Federal Reserve’s action in September to move its policy rate down by a “jumbo” cut signaled that there is more need to stimulate the economy than slow down inflation as 2025 approaches. As of Q4 2024, the consensus forecast is for real (inflation-adjusted) gross domestic product (GDP) to grow between 2.5 and 2.7%, for unemployment not to rise above 5%, and inflation to continuing moving toward 2% per year to the end of 2025. Among all the current noise and clattering to come, I want to provide four things to watch in 2025 and where key headwinds and tailwinds may exist to change that high-level and optimistic forecast for next year.

Labor markets have pressure to slow down

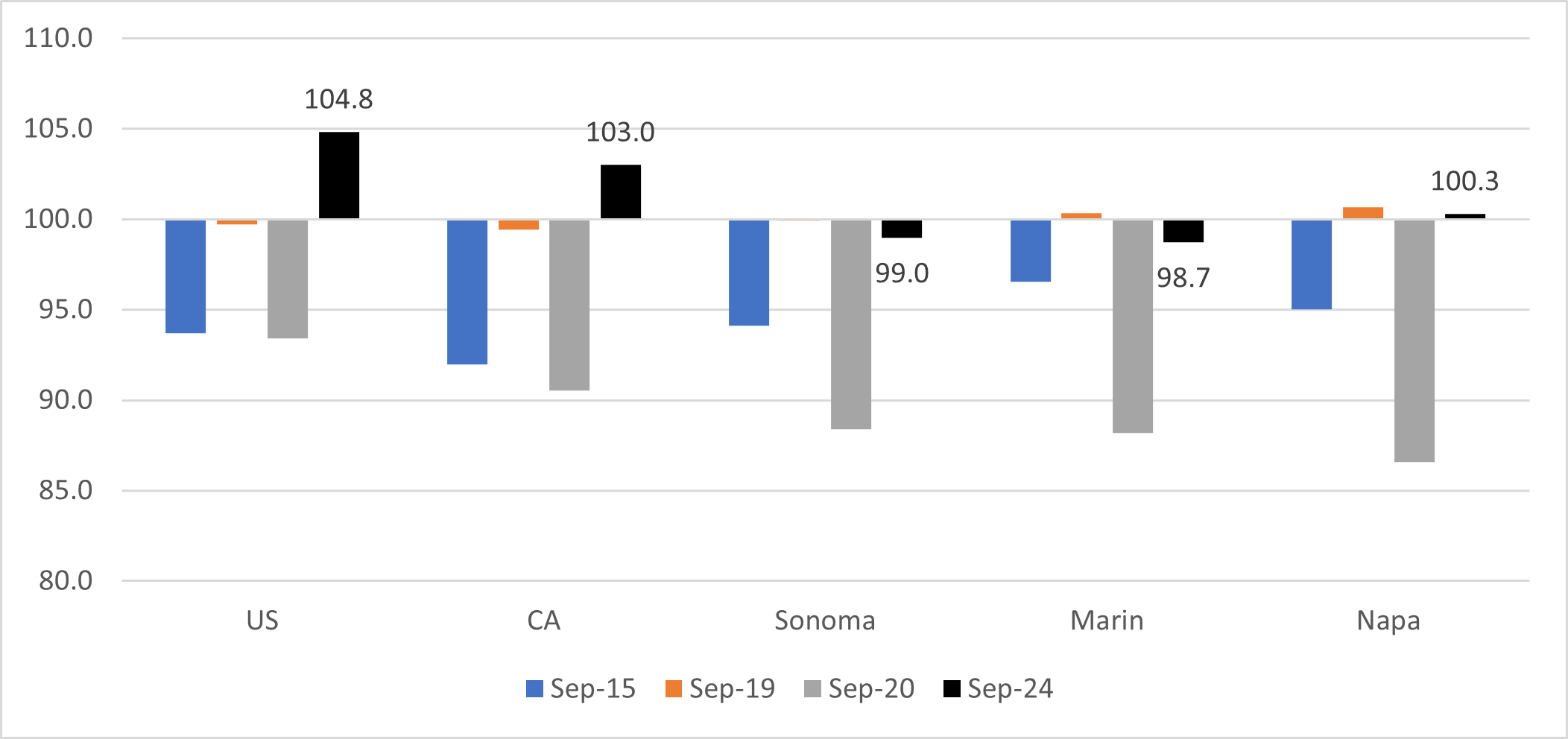

American labor markets have had slow pressure toward more job loss and lower demand for workers for the last 15 months. However, overall employment continues to grow nationally. For California, employers have continued to hire since 2022, but the estimated number of California residents with a job has been flat from July 2022 to September 2024 (reported as net negative but zero growth within the margin for error). For California (which is also true for the North Bay), local talent has been difficult to find, and likely to remain difficult in terms of employee search. Figure 1 shows the number of people hired in California, the North Bay counties of Marin, Napa and Sonoma, and the national economy since 2015 using September each year as a comparison to September 2024.

Figure 1: Non-Farm Employment, Selected Areas, Index Dec 2019 = 100

The American consumer is likely to slow down buying goods and services

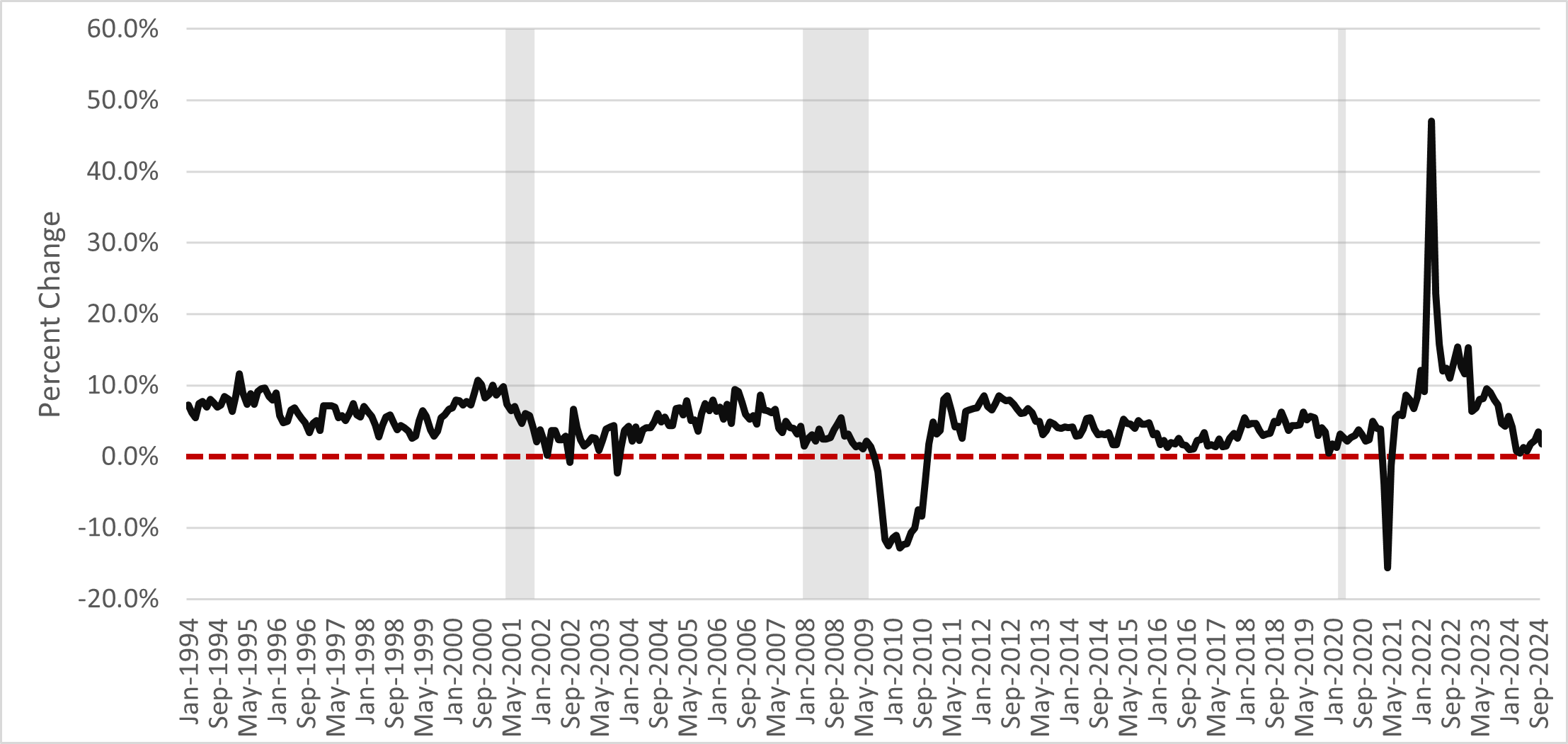

The pandemic had a long shadow effect in providing additional disposable income (in the form of fiscal stimulus, similar to a tax refund), employment preservation after a short period of time, and lower interest rates. Rising rates and inflation have slowed down retail sales activity, including restaurant meals, as shown in Figure 2. However, lower interest rates and slower inflation may help sustain some consumers in 2025. Notice in Figure 2, the annualized change in retail sales did not quite go negative yet (far right-hand side of figure).

Figure 2: Retail Stores, Current Dollars, Jan 1994 to Sept 2024, % Change from the Previous Year

A bubbly equity market with geopolitical uncertainty

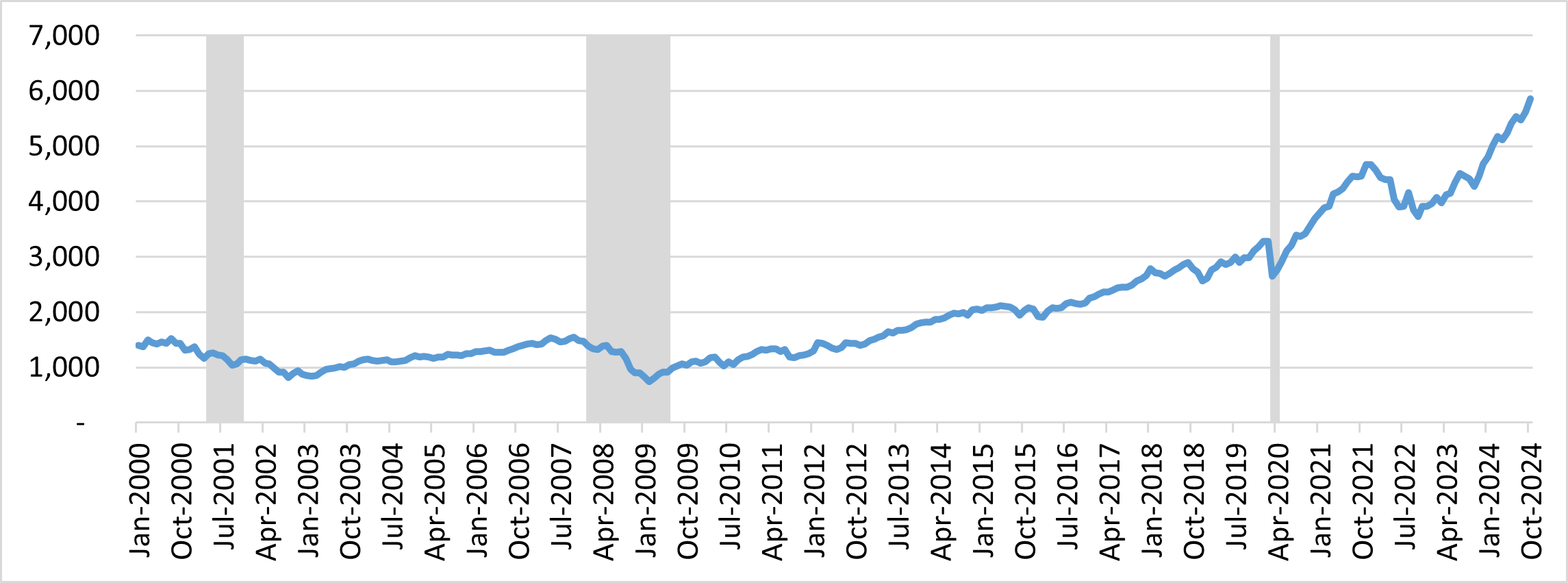

Equity markets have increased consistently since feeling some effects of rising interest rates in 2022 and 2023. Even with events providing relatively negative news globally (i.e., the tragedy of Oct. 7, 2023, outright war, escalating tensions in the Middle East, and continued attrition in Ukraine), equity markets have shrugged that off. Lower interest rates and the consumer’s resilience in the United States, some slow recovery from inflation and rising rates in Europe have helped markets remain frothy. Further, China’s economy is providing mixed signals (and some very negative trends), but has now seen its markets also become more optimistic—assuming China’s government will infuse funding to reduce risk, especially in China’s lending markets. You may be asking: “How much longer can this continue?” Your financial advisor may be asking the same. However, without a major shock to labor markets or inflation suddenly surging again, markets have bet on a slow and steady economy with a return to lower interest rates, fueling demand for equities.

Figure 3: S&P 500, Jan 2000 to Sept 2024, Index (1976=100)

Commercial real estate and soft landing?

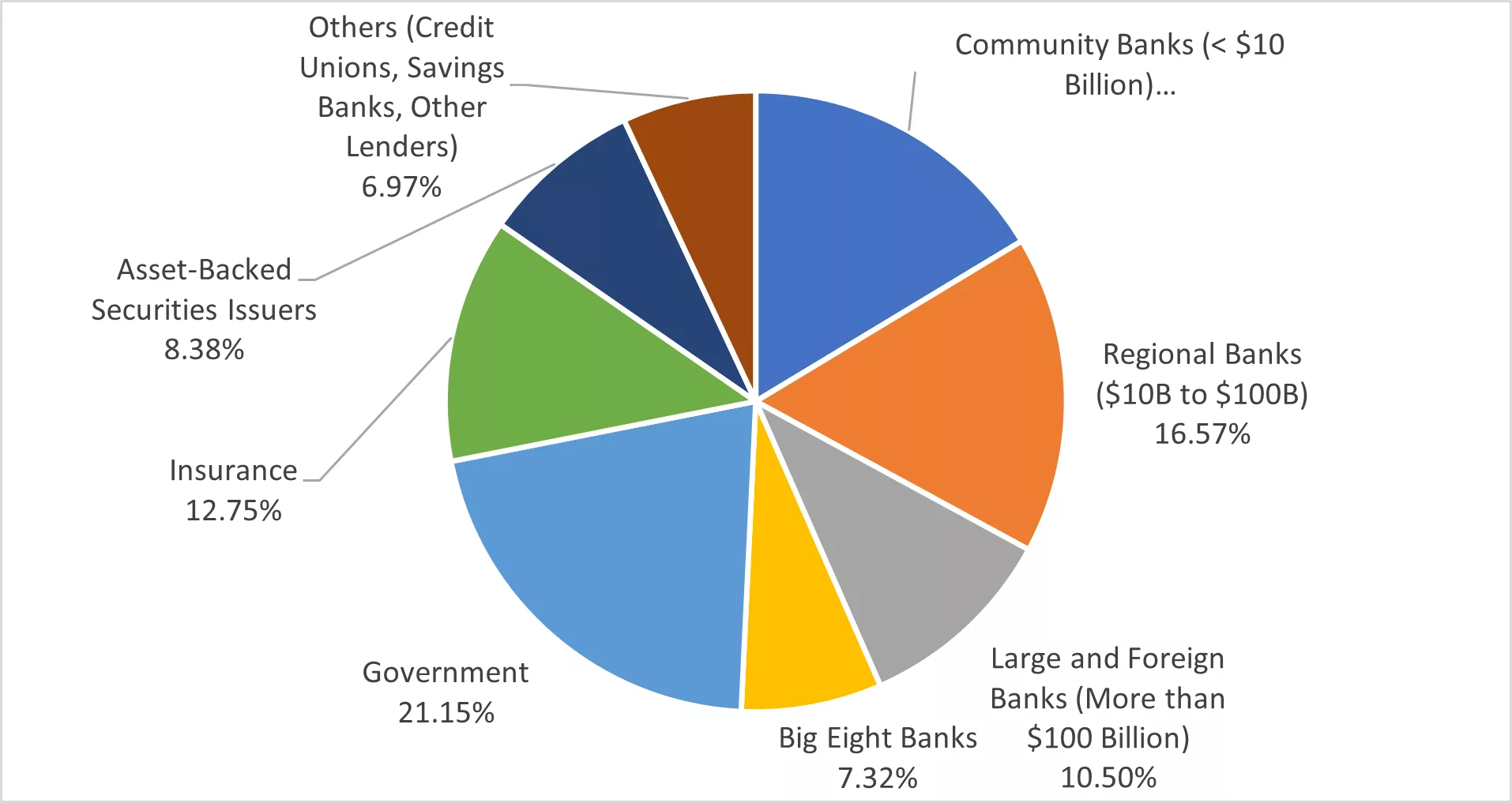

Office space has been under threat since the Great Recession. In the North Bay, tens of thousands of square feet of office space has remained vacant for over a decade. Has the pandemic permanently changed their demand? There is a need to watch loans in commercial real estate. Community and regional banks (generally those with less than $10 billion in assets) are exposed to more risk in commercial real estate than their larger counterparts. Figure 4 shows how financial markets have spread those loans among many lenders and financial firms. Watch for lingering commercial vacancies or decisions that leave large, new vacancies in their wake and may exacerbate pressure that creates empty retail or restaurant fronts in downtowns or smaller malls. This is an issue more about local economic development than it is a national financial crisis, as it is likely to happen slowly.

Figure 4: Q3 2024 Estimated Holdings of Commercial Real Estate Mortgages, $5.5 Trillion, % of Total

In summary, key headwinds and tailwinds for 2025 include:

| Headwinds | Tailwinds |

| Inflation’s compounding effects on lower- and middle-income households | Lower interest rates |

| Geopolitical uncertainty | Slowing Inflation |

| Household savings rates at low levels | Demand for workers remains above the available level of workers. |