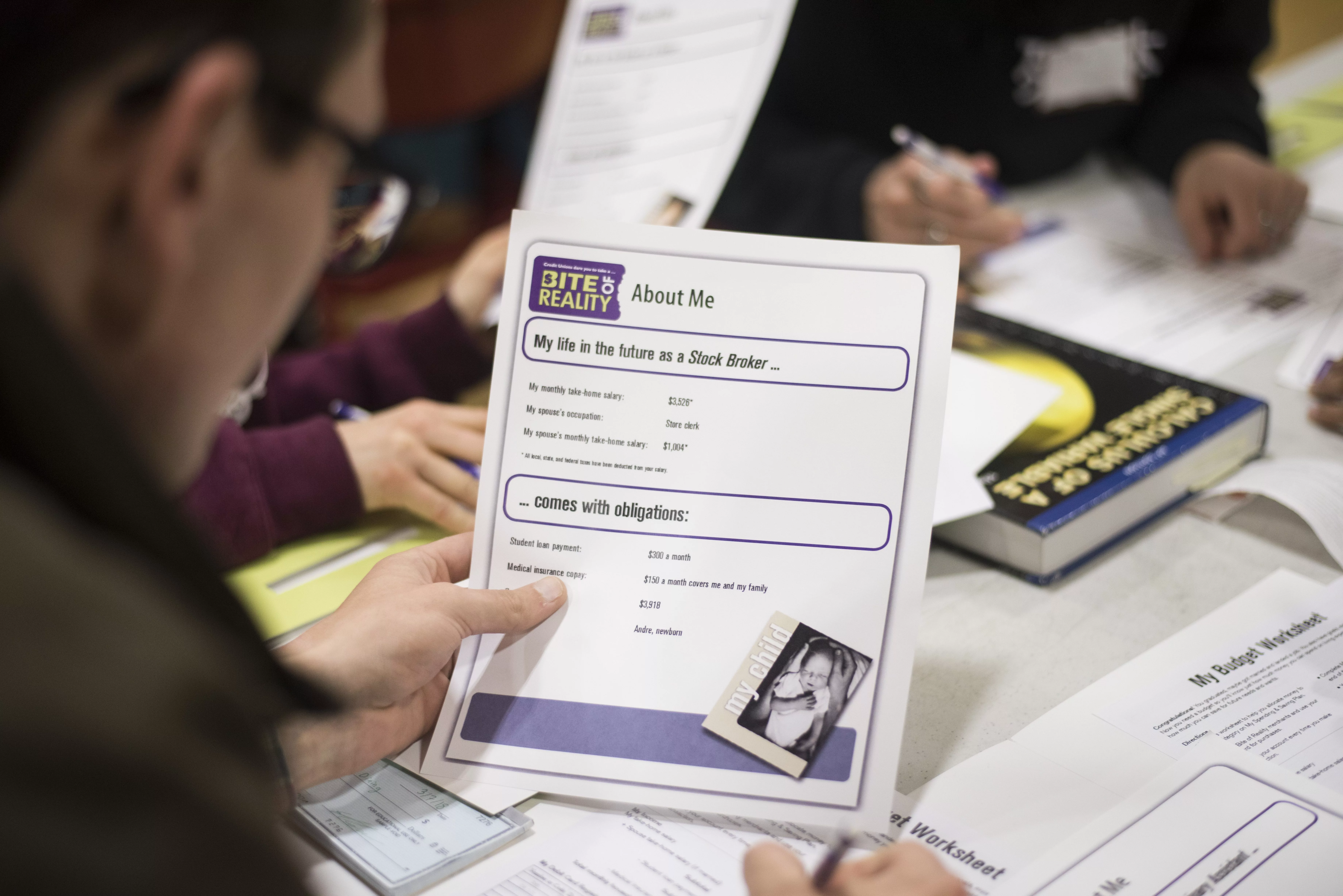

A Maria Carillo High School student is assigned a career as 'stock broker' with various personal obligations as part of an RCU Bite of Reality workshop in 2024. [Photo courtesy Redwood Credit Union]

From empowering youth to protecting against fraud, the financial well-being of its members and the community is at the heart of Redwood Credit Union’s mission and purpose.

Teaching teens about money

In 2013, Redwood Credit Union began presenting in high schools its Bite of Reality program, a workshop designed to immerse students in personal finance. The program helps equip young people with the knowledge and tools they need to thrive financially, setting them up for success in the future.

Matt Martin, Redwood Credit Union’s senior vice president of community and government relations, describes the program as an eye-opening glimpse into what “adulting” is like.

“While it’s a fun, interactive activity, students walk away with a reality check on how much it costs to have a car, a house and a family,” says Martin.

Using a mobile app, students participating in the workshop are assigned an occupation, credit score, dependents, credit card debt and other various obligations. The simulation features nine stations in total, eight of which are staffed by volunteer “vendors,” who sell such products as housing, transportation, childcare, food, clothes, entertainment, even makeup and skin care. The students purchase items from every station based on the salary profiles they were given at the beginning of the simulation.

“They learn that if a boat or an extravagant vacation is something they really want, they’ll have to make cuts in other places, like brewing coffee at home and skipping the daily coffee run,” explains Martin.

Martin points out that no one is born with the financial knowledge to reach one’s goals, but rather we benefit from learning from those who have gained that experience.

Martin says it’s gratifying to be part of the RCU team focused on teaching people how to manage their money. “It is so satisfying to see people be able to purchase the car or the house they’ve been working so hard for,” he says. “But it also helps us build stronger communities when the people living in them are financially knowledgeable.”

Besides offering the Bite of Reality program to local high schools and community colleges, RCU also offers financial education seminars for adults and through nonprofit partnerships like the Conservation Corps North Bay and New Door Ventures, among many others.

Fighting fraud

Another part of Redwood Credit Union’s outreach focuses on protecting the finances of its members and the broader community. In addition to a comprehensive fraud education center on their website, they have multiple systems in place to protect members, monitor for potential fraud, and notify members of unusual account activity.

“We have an amazing fraud team which works closely with our members to help in every way we can,” Martin says.

The dreaded fraud schemes and scams seem to be growing in number. Fortunately for its members, RCU has a Zero Liability Guarantee. When members use their digital services or credit and debit cards, they will not be held responsible for removal of any funds by someone they haven’t authorized.

“The best way to avoid becoming the victim of a scam is to be aware of the signs and know how they work,” Martin says. “We offer tips on our website security center, in our newsletters, and on our social media channels to help people spot a scam early and not fall for it.”

Martin says the best way to protect your accounts is by keeping your username, passwords, accounts numbers, and personal identification numbers (PINs) confidential and never sharing that information with anyone. They also recommend keeping your computer and mobile devices up to date with virus protection software.

“We suggest you log out of your account after each use when using digital banking, regularly monitor and reconcile account transactions, and report any unfamiliar, suspicious, or unauthorized account activity to RCU immediately.”

Although all age groups are at risk of being targeted for fraud in different ways, Martin says baby boomers are probably at highest risk because many of them have retirement savings. He says they are often targeted via computer tech support or Facebook scams.

That said, he notes a surprising number of young people are targeted through social media and approached for quick money-making schemes. Martin says all age groups can be seduced by money-making opportunities that are too good to be true.

“Our best advice is to pause if it feels too good to be true or if you’re being threatened into taking action. Take a moment and reflect on what you’re being asked to do,” Martin says. “Fraudsters will do everything to keep their victims on the line because they don’t want them to think or reach out for help.”

A “big red flag,” he says, is if someone is telling you not to contact your financial institution or is coaching you what to tell them. “Don’t be afraid to talk honestly to your financial institution. We are well-trained on fraud and scam scenarios and are here to help.”

Martin says that Redwood Credit Union’s purpose is to inspire hope and elevate the financial well-being of their communities, one person at a time, through good times and bad. “This focus is at the heart of everything we do,” he says.

“Whether it’s through financial education programs, fraud prevention efforts, or personalized member support, we strive to make a positive difference in the lives of those we serve,” he says. “We love helping people achieve their goals and dreams, and it’s incredibly satisfying to see the tangible results of our efforts in the community.”

He says his time at Redwood has reinforced his belief in the importance of financial education.

“It’s not just about numbers,” he says. “It’s about helping people achieve their dreams and building stronger, more resilient communities.”

For more information visit redwoodcu.org.